The 2022 Paving 50 contractors generated $742,226,477 in paving only sales which was significantly higher than last year which topped out at $681,489,281. That 2021 number reflects 75 total paving companies so it’s clear that paving is back in a big way. For reference, 2020 paving-only sales with 75 companies sat at $832 million and 2019 sales equaled $493 million with 50 companies.

The paving-only always out paces in terms of sales compared to the rest of the lists and this year is no exception. It’s clear that larger paving projects that may have been put on hold in 2020 rebounded last year and sales revenue reflects that.

Paving-only sales continue to dwarf sales of other industry segment with pavement repair-only sales at $247 million ($205 million last year), followed by sealcoating-only sales at $150 million ($108 million last year) and striping-only sales coming in at $534 million ($99 million last year)*.

*We are verifying sales of one large striping company which may have skewed numbers.

See all Top 50 Paving Contractors here.

Total Sales for Paving 50

Total sales for all the work the 2022 Paving 50 contractors did was $1.331 billion, down slightly but not much given 25 less companies on the list. Total sales of the 2021 Paving Top 75 was $1.336 billion. 2020 paving was $1.611, up from $1.046 billion generated from the 2019 list. When looking at the numbers side by side, it

This years paving-only sales represent 62% of total list sales - up from 59% in 2021's list. The remaining 38% of sales come from a broad mix of other pavement maintenance services:

- 45 companies perform sealcoating work

- 39 companies perform striping work

- 40 companies perform pavement repair work

The paving list results certainly reinforce the diversity within the industry – in fact, only 2 of the 50 companies on the list performs only paving, though most of the companies on the list generate the major share of their work from paving.

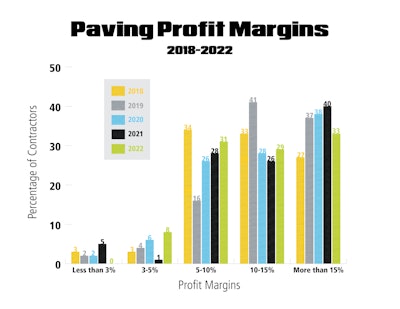

Profit Margins

As the chart shows, contractors profit margins within the 2022 Paving 50 continue to stay steady. The biggest fluctuation happens on the left side of the graph (less than 3% and 3-5%).

- The percentage of Paving 50 contractors reporting margins greater than 15% declined quite a bit this year with only 33% reporting over 15% profit, down from 40% last year

- Contractors reporting margins of 10-15% increased slightly to 29%

- Contractors in the 5-10% range rose to 31%, up from 29% last year

- 8% of contractors reported margins in the 3-5% range, up from 1% last year

- Thankfully, 0% of contractors reported margins of less than 3% which is less than last year where 3% of contractors reported this.

It’s not surprising that the larger percentage profit margins declined slightly this year. Cost of materials and paying more for labor are certainly two contributing factors, especially during the turbulent few years we have had.

Types of Jobs the Paving 50 Completed

All 50 companies report sales from parking lots (two companies reporting less than 5%) making this the largest segment of type of work completed. Followed by streets and roads at 64% (34 companies reporting more than 5% of this type of work) and driveway work at 48% (21 companies reported more than 5% of this type of work). Only 5% of companies reported highway work with only nine of the 50 companies reporting working on highways at all.

The Paving 50s' Customers

- All 50 contractors work for commercial/industrial customers

- 46 contractors work for multi-family residential customers

- 36 contractors work for municipal clients

- 25 contractors work for single-family homeowners

Despite the additional challenges 2021 brought to the industry, these figures remain consistent with past years results.

Replacing Equipment in the Paving 50s' Fleet

Paving is an expensive business so it’s not surprising that 33 of the Paving 50 companies reported it would cost more than $2 million to replace their equipment. Another 9 companies said it would cost between $1 and $2 million, while five companies reported it would cost between $500,000 and $1 million to replace their fleet. Only two companies reported in the $250,000-$500,000 range, while one company indicated they could replace their fleet for less than $250,000.