New U.S. housing construction has been bumping along curiously for the past several months. September’s drop of 1.6% in the seasonally adjusted annual rate of total starts is the first real momentum loss for a housing industry caught between phenomenal demand and the peculiar occurrence of that industry’s inability to build houses faster.

Really the storm’s fault?

The pandemic-induced shortage of construction inputs – materials and labor – that has been analyzed to death in recent weeks is the main villain. Its chokehold on construction productivity is expected to continue well into next year. click on the table for a larger viewdata: US Department of Commerce; table: ForConstructionPros.com

click on the table for a larger viewdata: US Department of Commerce; table: ForConstructionPros.com

But Hurricane Ida demonstrated in September how much damage global warming can do not only to lives and homes and infrastructure, but also to segments of the economy such as construction. The data tells the story.

The Department of Commerce’s monthly data release measured a remarkable 19.3% housing-starts leap in the West, and headline-making 6.9% growth in the Midwest. But builders’ work in the South and Northeast, directly in Ida’s path, also took a hit in the storm, resulting in 6.3% and 27.3% drops in starts, respectively.

Why climate matters

What’s climate change got to do with this? Well, Ida was a Category 1 storm (wind speeds from 74 to 95 mph) out in the Atlantic. Then it reached the Gulf of Mexico’s above-average 85-deg-F waters it jumped up to Category 4 (130 to 156 mph winds) in the hours just before making landfall. Warmer water gives hurricanes energy for faster winds, higher storm surge and much greater rainfall.

Consider Hurricanes Laura, Michael and Harvey, for example, which hit the U.S. in just the last few years. Before Harvey, says Andrew Dessler, professor in the College of Geosciences at Texas A&M University, a storm producing 60 in. of rain over the course of a three or four days would have been “unimaginable.”

“Whether we get storms that more rapidly intensify is something that people have been talking about in the last few years,” he adds. “A lot of scientists believe that’s something else we’ll get. We’ll get these storms that look anemic offshore and then spin up into monsters in 24 or 48 hours.”

That’s particularly bad for the people in those storms’ paths because it takes about 72 hours to evacuate a threatened population. But it also subjects exposed industries like construction in those regions to increasingly frequent risk and productivity loss.

It’s worth pointing out that the Commerce Department’s southern region – the one in the path of virtually all of these monster storms – is where half or more of all housing construction is started in the U.S. For perspective on how much impact that can have on housing construction, September single-family starts in the West leaped 17.8% and jumped 7% in the Midwest, but their 6.6% fall in the South (and a 1.5% slip in the Northeast – a market one-tenth the size of the South) held nationwide single-family starts flat for the month. Similarly, multifamily starts plunges in the South and Northeast dragged the national multifamily construction numbers down 5.1%.

Luckily, we’ve been on a roll

The storm’s affects were dramatic, but short-lived. Wells Fargo Economics reports that the six-month moving average for multifamily starts is running at an high 478,000-unit pace. It’s up more than 17% year-to-date, compared to the first nine months of 2020.

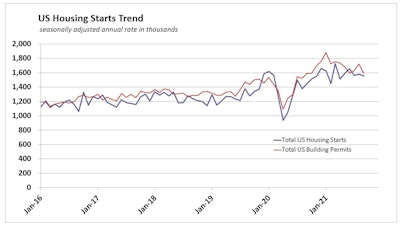

“This robust pace of activity indicates that climbing apartment rents, which have come along with resurgent leasing demand, are encouraging developers to move forward with projects,” says Mark Vitner, senior economist at Wells Fargo Securities. click on the graph for a larger viewdata: US Department of Commerce; graph: ForConstructionPros.com

click on the graph for a larger viewdata: US Department of Commerce; graph: ForConstructionPros.com

Single-family construction growth has cooled, with slight declines in the two months leading up to September’s stall at 1,080,000-unit annual pace. But activity remains strong. For context, the average seasonally adjusted annual pace of single-family construction between 2010 and 2019 was 682,000 units.

“A rise in the number of homes under construction and a decline in homes completed offer the latest evidence that home building continues to be hampered by building material and skilled labor shortages,” says Vitner. The number of homes under construction rose to a 1,426,000-unit pace, the highest since 1974. New home completions declined to a 1,240,000-unit pace. And total building permits sunk 7.7% during the month, reversing the strong gain seen the prior month. Multifamily permits fell 18.3%, while single-family permits slipped 0.9%

How long will buyers last?

Despite supply-side challenges, builders gained confidence in their ability to sell just about anything they can get on the market. The National Association of Home Builders’ Housing Market Index rose to 80 during October, its highest level in three months. Driving the overall gain was an increase in current single-family sales, which rose five points to 87 during the month. The future sales component also improved, climbing three points to 84. Meanwhile, prospective buyer traffic rose to 65.

Rising interest rates may be moving prospective buyers off the fence. A Freddie Mac statement on Thursday (reported by Bloomberg) said the average mortgage rate for a 30-year loan was 3.09%, up from 3.05% last week and the highest since April 8.

While still historically low, mortgage rates have crept up in recent weeks. Higher borrowing costs could cut into purchasing power for potential homebuyers scouring a real estate market that has run hot for the better part of two years. Between the years 2019 and 2020, residential construction spending saw its biggest year-to-year increase of the previous 15 years according to Fixr.com analysis of U.S. Census Bureau data.

![Hcm Ax Landcros Dual Branded Logo[25]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/11/hcmaxlandcros-dual-branded-logo25.Qhg3vUCjoK.jpg?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)