- Consumer demand remains high

- Construction employment improves slightly

- Construction inventories increasing

- New export orders increased in construction

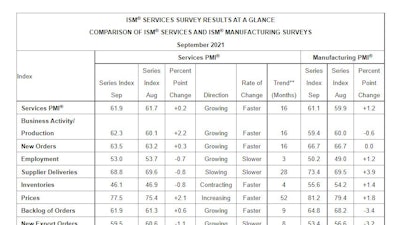

Despite supply chain disruptions, inventory shortages and price increases, the economy grew in September.

It was the 16th consecutive month of economic growth for the services sector, according to the nation’s purchasing and supply executives in the latest Services ISM Report on Business.

“I thought it was surprising that we’re continue on this strong trend,” says Anthony Nieves, chair of the Institute of Supply Management (ISM) Servies Business Survey Committee. “I thought we might have some slight pull back but we’re looking at, the numbers still remain strong. Growth, expansion for the sector is strong.”

The ISM Services PMI index is a set of economic indicators based off surveys of private-sector companies in the services sector, which includes construction.

The Services PMI registered 61.9%, 0.2 percentage point higher than the reading of 61.7% in August. The services sector has expanded for all but two of the last 140 months, according to the report.

“Constraints on logistics from a cost and availability standpoint continue to be an issue,” a survey respondent in the construction industry says.

The Supplier Deliveries Index registered 68.8%, down 0.8 percentage point from August’s reading of 69.6%. Supplier Deliveries is the only ISM Report on Business index that is inversed; a reading of above 50% indicates slower deliveries, which is typical as the economy improves and customer demand increases. The Prices Index registered 77.5%, up 2.1 percentage points from the August figure of 75.4%.

“According to the Services PMI, 17 services industries reported growth,” Nieves says. “The composite index indicated growth for the 16th consecutive month after a two-month contraction in April and May 2020. The slight uptick in the rate of expansion in the month of September continued the current period of strong growth for the services sector. However, ongoing challenges with labor resources, logistics, and materials are affecting the continuity of supply.”

Industry Performance

The 17 services industries reporting growth in September, listed in order, are: retail trade; arts, entertainment and recreation; management of companies and support services; educational services; transportation and warehousing; real estate, rental and leasing; accommodation and food services; construction; mining; professional, scientific and technical services; other services; information; health care and social assistance; utilities; public administration; wholesale trade; and finance and insurance. The only industry to report a decrease is agriculture, forestry, fishing and hunting.

Commodities

The following commodities were up in price (the number of consecutive months the commodity is listed is indicated after each item): aluminum (three); aluminum products; bacon; beef; chemicals; chicken; construction contractors (three); copper products (three); corrugated products; diesel (10); electrical components (eight); electronics; food; food and beverages (two); freight (five); fuel (nine); gasoline (10); hardware; labor (10); labor — construction (two); labor — temporary (nine); logistics services; ocean freight; paper products (two); plastic products (two); poly film products; polyvinyl chloride products; postage; printing; resin-based products (three); steel — stainless (two); and steel products (nine).

The following commodities were down in price: lumber (three); oriented strand board and rental cars.

The following commodities are in short supply: adhesives; blood collection tubes; chicken; computer equipment (two); construction contractors; construction subcontractors (two); covid-19 testing kits; drivers; electrical components; fiber-optic cable (three); generators; heating, ventilation and air conditioning equipment; labor (two); labor — temporary (nine); laptops and desktop computers (two); media supplies; microchips (two); needles and syringes (two); ocean freight containers; pipette (seven); polypropylene; resin-based products (two); steel products; surgical gloves and truck drivers.

A Services PMI above 49.2%, over time, generally indicates an expansion of the overall economy. Therefore, the September Services PMI indicates expansion for a 16th straight month following two months of contraction and a preceding period of 127 months of growth. The Services PMI for September (61.9%) corresponds to a 4.5-%increase in real gross domestic product (GDP) on an annualized basis, Nieves says.

ISM

ISM

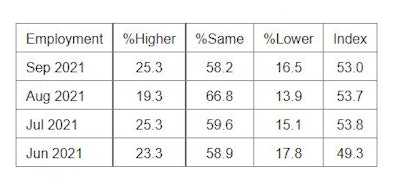

Employment

Employment activity in the services sector grew in September for the third consecutive month after contracting in June. ISM’s Services Employment Index registered 53% in September, down 0.7 percentage point from the August reading of 53.7%.

“It’s been three months of employment growth,” Nieves says. “Construction always had a shortage and we’re seeing that continue.”

Comments from respondents include: “Employee flight to better-paying jobs and lack of a pipeline to replace” and “Labor shortages experienced at all levels.”

The 14 industries reporting an increase in employment in September, listed in order, are: arts, entertainment and recreation; retail trade; construction; transportation and warehousing; educational services; management of companies and support services; finance and insurance; professional, scientific and technical services; mining; other services; accommodation and food services; information; utilities; and wholesale trade. the three industries that reported a reduction in employment in September are: agriculture, forestry, fishing and hunting; health care and social assistance; and public administration.

ISM

ISM

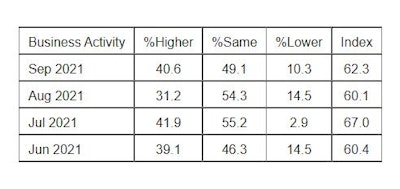

Business Activity

ISM’s Business Activity Index registered 62.3% in September, an increase of 2.2 percentage points from the August reading of 60.1%.

Comments from respondents include: “Business volume has increased slightly, and we are dealing with severe supply chain disruption” and “Taking on new contracts.”

The 17 industries reporting an increase in business activity for the month of September, listed in order, are: retail trade; arts, entertainment and recreation; educational services; real estate, rental and leasing; health care and social assistance; management of companies and support services; professional, scientific and technical services; information; utilities; finance and insurance; wholesale trade; accommodation and food services; public administration; other services; construction; mining; and transportation and warehousing. The one industry reporting a decrease in September is agriculture, forestry, fishing and hunting.

ISM

ISM

New Orders

ISM’s New Orders Index registered 63.5%, an increase of 0.3 percentage point from the August reading of 63.2%. New orders grew for the 16th consecutive month after two months of contraction and a preceding period of 128 months of expansion.

Comments from respondents include: “New customers added, which has led to greater sales orders and business activity” and “New orders have increased due to pent-up demand coming online.”

The 17 industries that reported growth of new orders in September, listed in order, are: retail trade; arts, entertainment and recreation; other services; real estate, rental and leasing; educational services; professional, scientific and technical services; mining; transportation and warehousing; public administration; construction; management of companies and support services; utilities; health care and social assistance; information; finance and insurance; accommodation and food services; and wholesale trade. The one industry reporting a decrease in September is agriculture, forestry, fishing and hunting.

ISM

ISM

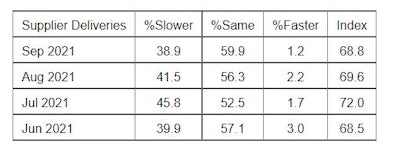

Supplier Deliveries

The Supplier Deliveries Index registered 68.8%, which is 0.8 percentage point lower than the 69.6% reported in August. A reading above 50% indicates slower deliveries, while a reading below 50% indicates faster deliveries.

Comments from respondents include: “Shortages of multiple products due to port backlog and shortage of long-haul truck drivers” and “Reports of suppliers being unable to staff their warehouses due to COVID-19 creating more backorders and longer lead times.” Also, “Container deliveries are definitely slower; we do not expect this to improve for another 12 to 18 months.”

The 17 industries reporting slower deliveries in September, listed in order, are: management of companies and support services; accommodation and food services; transportation and warehousing; mining; health care and social assistance; public administration; retail trade; wholesale trade; construction; information; educational services; utilities; agriculture, forestry, fishing and hunting; real estate, rental and leasing; other services; professional, scientific and technical services; and finance and insurance. No industries reported faster supplier deliveries in September.

ISM

ISM

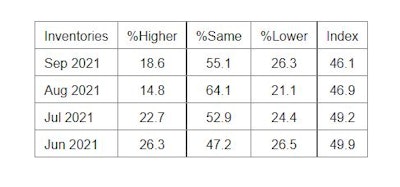

Inventories

The Inventories Index contracted in September for the fourth consecutive month. The reading of 46.1% was a 0.8-percentage point decrease from the 46.9% reported in August.

Of the total respondents in September, 36% indicated they do not have inventories or do not measure them.

Comments from respondents include: “Trying to build up stock due to supply chain issues” and “Burning through inventories and unable to replace.”

“Business volumes remain remarkably high, although material shortages persist,” says one survey respondent from the real estate, rental and leasing sector.

“Demand far outweighs supply for goods and services,” says one survey respondent from the transportation and warehousing sector.

The nine industries reporting an increase in inventories in September, listed in order, are: arts, entertainment and recreation; transportation and warehousing; construction; educational services; utilities; mining; accommodation and food services; wholesale trade; and health care and social assistance. The six industries reporting a decrease in inventories in September, listed in order, are: agriculture, forestry, fishing and hunting; real estate, rental and leasing; retail trade; other services; information; and public administration.

ISM

ISM

Prices

Prices paid by services organizations for materials and services increased in September, with the index registering 77.5%, 2.1 percentage points higher than August’s reading of 75.4%.

All 18 services industries reported an increase in prices paid during the month of September, in the following order: management of companies and support services; transportation and warehousing; real estate, rental and leasing; retail trade; wholesale trade; other services; arts, entertainment and recreation; public administration; construction; utilities; accommodation and food services; information; educational services; mining; finance and insurance; agriculture, forestry, fishing and hunting; professional, scientific and technical services; and health care and social assistance.

ISM

ISM

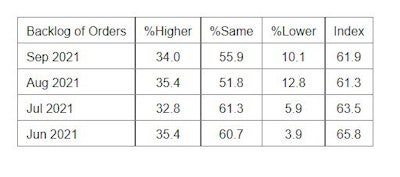

Backlog of Orders

The ISM Services Backlog of Orders Index grew in September for the 15th time in the last 16 months. The index registered 61.9%, a 0.6-percentage point increase compared to the 61.3% reported in August. Of the total respondents in September, 42% indicated they do not measure backlog of orders.

The 13 industries reporting an increase in order backlogs in September, listed in order, are: accommodation and food services; real estate, rental and leasing; other services; transportation and warehousing; health care and social assistance; public administration; wholesale trade; utilities; educational services; professional, scientific and technical services; finance and insurance; information; and construction. The three industries that reported a decrease in backlogs in September are: arts, entertainment and recreation; agriculture, forestry, fishing and hunting; and management of companies and support services.

ISM

ISM

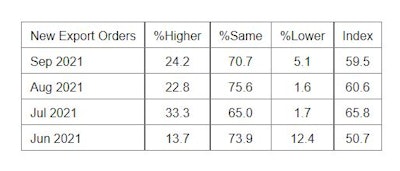

New Export Orders

Orders and requests for services and other non-manufacturing activities to be provided outside of the U.S. by domestically based companies grew in September for the eighth consecutive month. The New Export Orders Index registered 59.5% in September; 1.1 percentage points lower than the 60.6% reported in August. Of the total respondents in September, 75% indicated they either do not perform, or do not separately measure, orders for work outside of the U.S.

The 11 industries reporting an increase in new export orders in September, listed in order, are: arts, entertainment and recreation; construction; utilities; real estate, rental and leasing; information; accommodation and food services; professional, scientific and technical services; finance and insurance; transportation and warehousing; wholesale trade; and health care and social assistance. The two industries reporting a decrease in new export orders in September are: management of companies and support services; and other services.

ISM

ISM

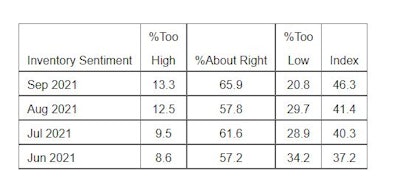

Inventory Sentiment

The ISM Services Inventory Sentiment Index contracted in September for the sixth consecutive month, registering 46.3%, 4.9 percentage points higher than August’s figure of 41.4%. This indicates that respondents feel their inventories are too low when correlated to business activity levels.

The seven industries reporting sentiment that their inventories were too high in September, listed in order, are: mining; finance and insurance; accommodation and food services; utilities; construction; health care and social assistance; and information. The eight industries reporting a feeling that their inventories were too low in September, listed in order, are: agriculture, forestry, fishing and hunting; educational services; retail trade; professional, scientific and technical services; public administration; other services; transportation and warehousing; and wholesale trade.