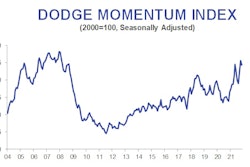

The last two years have been challenging, to say the least. As we begin to emerge from the COVID-19 pandemic, Dodge Data & Analytics is predicting a 6% rise in construction starts for 2022 and a "bright and busy future" for the industry.

"We expect total starts to be above 2019 levels in 2022, mainly due to the residential sector," Richard Branch, chief economist for Dodge said during their quarterly economic forecast event. "Quarterly growth rates will be slow over the course of the next year however. It represents an economy that is getting off a sugar high and getting in to a more sustainable growth pattern."

Impact of Infrastructure Bill

With the lack of funding certainty associated with the FAST Act expiring this year, spending for non-residential projects was flat in 2021.

"The flat growth in 2021 was due to the short-term extension of FAST Act funding levels at a flat rate," Branch said. "States are cagey in bringing projects forward until they get an indication from Washington as to what that infrastructure bill will be. Projects and spending will not be announced until then."

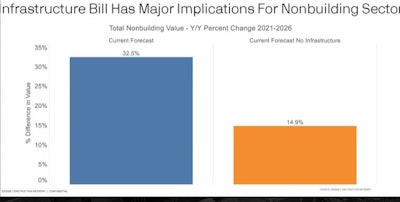

Therefore, anticipated growth in this area will be heavily impacted by the passage of Infrastructure Investment & Jobs Act (IIJA). The bill would inject $550 billion in new spending for our roads, bridges and other hard infrastructure over a five-year period. Enactment of the IIJA would also provide highway and public transportation programs with a five-year, $370 billion reauthorization along with additional supplemental spending to improve surface transportation and other infrastructure networks.

"Dodge has been forecasting a $550 billion increase in federal funding for highways since April," Branch said. "We will see a 32% increase in construction starts over the next five years if this bill is passed. If the bill is not passed, the growth rate falls almost in half to 14.9% over five years, which is very weak."

While the impact of this funding will be felt immediately, an even stronger influence will be felt from 2023-2025 as the funding trickles through to larger projects.

"We anticipate states will want to tick those larger projects off their list first with these dollars," Branch says. "We assume 80% of these dollars will be spent by 2026."

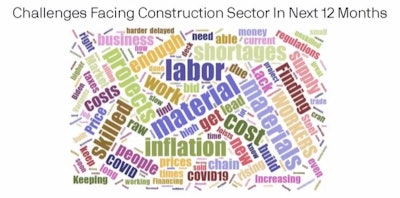

People, Prices & Productivity Could Hinder Growth

The impact of COVID-19 is still very much being felt across our industry. Materials are harder to find. People are harder to find. And completing work in an efficient manner while maintaining profit margins is an ever-increasing struggle.

People

According to Cris deRitis, deputy chief economist for Moody’s Analytics, there are 10.4 million job openings as of August 2021 with 7.7 million people officially unemployed and looking for work. Of those unfilled positions, 350,000 are in the construction industry.

With more jobs than people, the labor market has never been more challenging, causing companies to shift how they attract and retain talent. As a result, wages are up 4% because of the demand for workers.

"Luckily, business profit margins are up as well so there is potential for businesses to absorb some of these increases," deRitis said. "However, if these gains are sustained, profit margins will begin to compress and businesses and consumers will suffer."

Prices

Supply chain issues have riddled the construction industry for the last year. Rising prices and lack of materials have kept prices higher than they otherwise would be, causing some project owners to pull back on construction starts.

"Project starts normally take about three months to get off the ground," Branch said. "Right now, the lag for projects to start is about eight months. Starts will grow in 2022 but it’s going to be modest because projects are taking longer to start and this lag is due to higher prices prices and fewer people. Prices and shortages will persist beyond 2021, leading to longer lead times from planning to ground breaking and your company needs to be prepared."

Productivity

With less people to do the work and all of the activity happening at a higher price, the construction industry must find ways to improve our productivity. If we don't, growth will be incredible hindered.

"Digital transformation and productivity enhancements are needed," Brand said. "Companies have made great strides in using data to better manage their operations but more needs to be done. Make sure you’re investing in research and processes that will improve your productivity. Labor shortages will persist beyond 2022 and you need to invest in technology and processes to do more work with less."