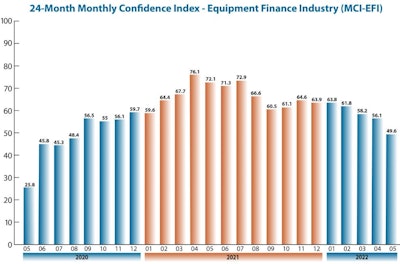

Once again, the Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) has dropped. Produced by the Equipment Leasing & Finance Foundation, the index was 63.9 in January, 61.8 in February, 58.2 in March, 56.1 in April and 49.6 for May—a 22.3% decrease for the year.

The index aims to assess business conditions and expectations for the future, based on feedback from equipment finance executives.

“Adapting to change is what the equipment leasing industry is all about. Our current rising rate environment will be good for the overall financial health of equipment finance companies as obligors adapt to the new world rate order and margin is built back into the business. I do think this will create challenges for many who may not have a long-term stable capital structure," said David Normandin, president and CEO, Wintrust Specialty Finance, as part of the responses that comprise the index.

According to the foundation, when asked to assess their business conditions over the next four months, 6.9% of executives responding said they believe business conditions will improve over the next four months, a decrease from 14.8% in April.

- 10.3% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, down from 29.6% in April. 65.5% believe demand will “remain the same” during the same four-month time period, an increase from 55.6% the previous month. 24.1% believe demand will decline, up from 14.8% in April.

- 13.8% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, down from 22.2% in April. 86.2% of executives indicate they expect the “same” access to capital to fund business, an increase from 77.8% last month. None expect “less” access to capital, unchanged from the previous month.

- When asked, 48.3% of the executives report they expect to hire more employees over the next four months, up from 40.7% in April. 44.8% expect no change in headcount over the next four months, a decrease from 59.3% last month. 6.9% expect to hire fewer employees, up from none in April.

- 3.5% of the leadership evaluate the current U.S. economy as “excellent,” a decrease from 14.8% the previous month. 79.3% of the leadership evaluate the current U.S. economy as “fair,” up from 74.1% in April. 17.2% evaluate it as “poor,” an increase from 11.1% last month.

- 3.5% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 7.4% in April. 27.6% indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 51.9% last month. 69% believe economic conditions in the U.S. will worsen over the next six months, an increase from 40.7% the previous month.

- In May 34.5% of respondents indicate they believe their company will increase spending on business development activities during the next six months, up from 29.6% the previous month. 65.5% believe there will be “no change” in business development spending, down from 66.7% in April. None believe there will be a decrease in spending, down from 3.7% last month.

“Supply chain issues continue to have an impact on lease commencements with dates getting pushed with delivery delays. We are seeing an increase in renewals and over term rentals,” said Michael Romanowski, president of Farm Credit Leasing, in his index response.