As jobsites become more connected, contractors and construction companies gather thousands of data points for later use. These data points could be monetized and shared with others outside the industry for even greater good and connectivity, according to the the Association of Equipment Manufacturers (AEM). From weather mapping with cloud-based systems to wearables detecting when people take falls, the bright future of construction site technology that AEM details in its latest whitepaper suggests more than just contractors and operators can benefit from data collection and interconnectivity.

AEM presented 10 top trends for the future of building construction on Thursday, September 8, among them alternative power, the electrification of compact equipment, autonomous machinery and sensors for increased safety. Hosted by Brooke Konopacki, AEM senior director of community insights, and Ray Gallant, Volvo vice president of product management and productivity region, the webinar presentation of these top trends delineated a recent whitepaper the association published, an in-depth analysis of the leading influences that could dramatically impact the construction industry over the next decade.

The top 10 trends include:

- Increased Regulation of Carbon-based Fuels Spurs Adoption of Alternative Power Solutions

Referencing recent aviation fuel regulations plans, the California Air Resources Board’s (CARB) ban on small engines on new equipment starting in 2024, the Environmental Protection Agency’s (EPA) new greenhouse gas emissions rules for 2023-2026 passenger vehicles and light-duty trucks and the EPA’s plan to reduce greenhouse gas emissions from heavy-duty trucks starting with 2027 models, the AEM whitepaper asserts that construction companies will see their fleets change over the next decade, as well.

“A significant level of investment into the development of a wide swath of alternative power solutions is well underway. Long-term, it isn’t practical to pursue all of the options being explored due to the needed infrastructure surrounding each power source,” the AEM analysis states. “Once solutions are vetted, the construction industry can expect more than one to be leveraged in their fleet based on the varying power and performance needs of each piece of equipment. Over the next 10 years, a rationalization of a few select power solutions to reduce carbon emissions will take place that infrastructure can then be built around.”

Whether these alternative power solutions will be hydroelectric, biofuels or otherwise is not clear yet, but the current focus for construction equipment is on electrification, Gallant said, due to the availability of charging stations.

2. Renewable Energy Production Booms

“The Center for Climate and Energy Solutions states that renewable energy is the fastest-growing energy source in the U.S., increasing 42% from 2010-2020,” AEM writes. “Furthermore, U.S. Energy Information Administration data shows that renewables now account for roughly 12% of U.S. energy consumption.”

Major corporations continue to invest in renewable energy like biofuels, solar and wind power, as construction companies and large contractors commit to net-zero impact pledges for new buildings and infrastructure.

“Construction companies will be critical in the nationwide energy transformation,” the AEM whitepaper says. “Beyond taking steps to lower their own GHG emissions, construction companies will build the vital infrastructure necessary to help renewable energies claim a significantly larger share of total energy consumption over the next 10 years.”

3. Compact Equipment Trends Electric

“Gas-powered leaf blower bans in parts of California and other municipalities around the country can be viewed as a precursor to what will ultimately happen in construction,” reads the AEM analysis. “Regulations that greatly limit or ban the use of gasoline engine-powered equipment, as recently seen in California with small engines used in landscaping equipment, will also accelerate the trend toward electrification.”

The push toward electrification of skid steers, compact excavators and compact loaders already has been seen and well-documented. The United States’ commitment to cutting carbon emissions by 50% by 2030 will spur “the electrification of many segments of the compact construction equipment market” over the next 10 years, according to AEM.

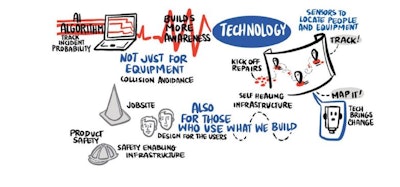

4. Connectivity Leads to Jobsite Transformation

Simply put, due to more advanced 5G networks and cloud systems, connectivity on the jobsite will improve significantly in the next decade, according to AEM’s data and projections. Better equipment tracking will allow real-time visibility into productivity and maintenance on a jobsite, so operators and contractors can make sure they queue properly and have the most efficient job flow they can, Gallant said.

5. Pathway Toward Autonomous Machinery

From long-adopted technologies like automatic grade control to newer ones like robotic rebar tying, autonomous machinery is on the rise to help eliminate repetitive, laborious, and often-dangerous tasks.

“So, we can have autonomous machines that are simply operator assist, or you can go all the way to a fully autonomous, no operator, no intervention machine,” Gallant said. “So, we’re not saying that in the next 10 years everything is going to be fully autonomous and have no operators. But we are thinking that the smarter the devices become, the more we can assist the operators to be more efficient, to be more productive, to be more fuel efficient, more energy efficient, and therefore have less carbon impact, as well.”

The implications for autonomous machinery as aids in a construction labor shortage are important, Gallant emphasized. Autonomous machinery changes the nature of operational machines, requiring a different skillset from operators but, most likely, fewer people needed on the jobsite.

6. Sensors Improve Efficiency and Safety

Sensors on the jobsite, from safety backup sensors for skid steers to wearables that help detect worker falls, will proliferate in the next decade, according to AEM.

“It starts with understanding what’s going on on the site and that’s where sensors really came into it. There already are a number of internet-connected devices—sensors on the machines that are feeding information all the time,” Gallant said. “Our problem has not been getting the information. It’s been how we use it, how to consolidate it and how we use it smartly. And that’s, I think, the next big frontier here…We get better and better at controlling the sites and helping the operators be better, more efficient, more sustainable operators.”

7. Fewer Workers, Different Skillsets

The future of construction labor is the hottest topic in construction news right now, particularly as the U.S. economy weathers the ups and downs of a pandemic, supply chain challenges, record inflation and low unemployment.

“During a 2021 CONEXPO-CON/AGG Tech Talk, a road construction contractor said technology will help the industry replace the large numbers of experienced workers who are beginning to retire,” the AEM whitepaper states:

“’We need to find a way to attract young workers if we are going to keep this industry stable,’ said Rod Stephens, president of All Roads Construction in British Columbia. ‘Instead of putting a shovel in their hands, we put a joystick in their hands.’”

Gallant agreed. Generation Z, people born after the mid-1990s, are already quite familiar with the type of work that can be achieved electronically and remotely, Gallant asserted.

“They’re not that much interested in getting into a miachine and operating on a site 100 miles away from home, but they do like the idea of getting into a simulator and operating a machine 100 miles away, doing that job that way,” Gallant said. “We’re going to need these new technologies to finish the work that needs to be done even with fewer workers.”

8. Business Models Shift Toward Subscriptions

High-tech equipment like autonomous machinery can be expensive, and that is where rental and shared equipment schemes will come into play in the next decade, according to AEM. Equipment as a Service (EaaS) will give contractors and construction companies the option to lease equipment for a designated period of time, allowing users to “gain access to the newest, most technologically advanced equipment without having to outlay large sums of money to own it,” the AEM whitepaper states.

Presumably, the users also would not have to maintain the equipment beyond normal daily troubleshooting on the jobsite, freeing up fleet management time and budgets. Each contractor and construction company will need to make leasing, rental or ownership decisions based on what best fits their businesses, both the AEM whitepaper and Gallant emphasized.

9. Construction Data Will Reveal Its Value

While construction sites currently can collect thousands of data points, both AEM and Gallant emphasized that making this data usable to others is the primary trend forecasted for the next decade.

“You could have, you know, 50,000 [data] points, gathering weather data, and very easily convert that to a very accurate weather map, rather than having conventional weather-gathering stations that are only every 50 miles or every 100 miles,” Gallant said.

The future of monetizing data on construction sites for those outside the industry is ripe, Konopacki agreed. “It doesn’t have to be data that is necessarily used within the business, and, so, that can be sold and leveraged in potentially very surprising and new ways that we haven’t creatively been able to [before],” Konopacki said. “I think that’s the exciting part of this one.”

10. Cybersecurity Becomes Central to Corporate Strategy

Connected equipment and Building Information Modeling (BIM) software programs are often vulnerable to cyberattacks, according to AEM. The more connected jobsites become, Gallant said, the more they automate. Two-way flows of data will increase.

So, the more you open up the [system], the more vulnerable it is,” Gallant said. “The federal government is on this—they’ve invested $1 billion of the $1.2 trillion infrastructure bill specifically on cybersecurity…It’s an important thing that the federal government realizes all companies deal with this.”

Even a residential house or apartment building has thousands of internet-entry points, Gallant said, pointing out increased use of connected refrigerators, televisions, and even trash cans in the modern, connected smart home.

“Cybersecurity, it’s unfortunately the dark side of this, but it’s something that we have to be very aware of and keep pace on protecting these systems, so that we can take advantage of them and can use them freely as they develop,” Gallant said.

Contractors to Lead Transformation of the Jobsite Over the Next Decade

AI and connectivity will lead in transforming construction worksites over the next decade, Gallant said, as renewable energy sources and alternative fuels make their way into the construction equipment market.

“I think it’s important as business leaders of the industry, that every once in a while, we have to step back and take a look at the long term,” Gallant said. “Where are we going? What should we be pursuing?”