The Dodge Construction Network released its Dodge Momentum Index (DMI) for April 2024, which increased due to demand for new data centers. Other areas are not as robust, as developers wait for interest rates to cool down before committing to additional projects.

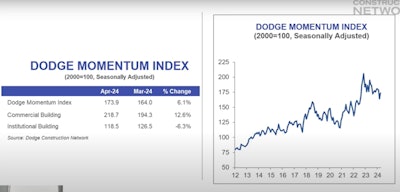

The DMI is an economic indicator for nonresidential building projects, tracking the dollar value of these projects in the earliest stages of planning, which typically leads construction spending by about 12 months. A total of 25 projects valued at $100 million or more entered planning last month.

Dodge Construction Network

Dodge Construction Network

The index increased 6.1% in April, to a reading of 173.9. The commercial segment improved 12.6%, while the institutional segment was down 6.3%.

In a video presentation, Sarah Martin, Dodge Construction Network’s associate director of forecasting, discussed the latest trends in construction planning queue.

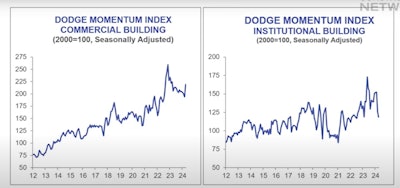

“Outsized demand to build cloud and AI infrastructure right now is supporting the above average activity in the sector," Martin said of the commercial sector.

Most other categories faced slower growth, she said.

"On the commercial side, that flood of data center projects was the primary driver of all of the growth that we saw this month," Martin said. "Traditional office and hotel projects saw slower momentum and warehouse planning activity was basically flat."

Dodge Construction Network

Dodge Construction Network

For institutional construction, growth was weaker due to a slowing in laboratory construction.

"Lab construction has experienced significant demand in recent years, so as the market absorbs all of that new supply that’s coming online in 2024, it’s no surprise that we’re seeing slower planning activity as a result," Martin said.

Year over year, the DMI is now 1% lower than in April of 2023. The commercial segment is up 6% from year-ago levels, while the institutional segment is down 15% over the same period, she said.

"Outside of data centers, it’s likely that owners and developers are grappling with continued labor shortages and a lot of uncertainty around where interest rates are going in 2024. So it’s likely they’re delaying decisions to push projects into the planning queue until they’re a little more confident about what’s going to happen," Martin said. "If interest rates begin to tick down in the latter half of 2024, more substantive growth in nonresidential planning activity should follow."