Dodge Construction Network has released its 2024 Mid-Year Outlook ebook, which estimates the success of various construction sectors (residential, nonresidential and public works) for the remaining part of the year. Overall, the outlook is positive for the second half of 2024, going into the election season with expectations of Federal Reserve rate cuts.

"The new assumption is that rate cuts (25 bps each) will come in September and December, bringing the target range to 4.75 percent to 5 percent by year end," the report stated. "Cuts will continue at 25 bps per quarter until the target rate reaches 3 percent by late 2026."

Overall, Dodge expects construction starts to increase at a 10 percent rate, reaching $2.4 billion in 2024.

Consistency will be key to the construction industry's economy, the report stated. While hiring is cooling overall, the market should be stable.

"The economy should be more consistent in 2024 than over the last two years," the report said. "This consistency will bring increased opportunities to the nation’s construction verticals."

Nonbuilding Construction

Infrastructure is expected to see the biggest wins this year, with the Infrastructure Investment and Jobs Act (IIJA) funding bridges and roads. In 2024, construction in this segment is expected to grow by 15 percent this year to $347 billion. Public works will grow 22 percent over the year to $272 billion, while power/utilities will pull back 6 percent to $74 billion, according to the report.

"Likely, Congress will not act on next year’s (FY2025) spending bills before the end of this fiscal year. Instead, the current Congress will pass a continuing resolution to keep the government open until a new Congress is sworn in, and the appropriations bills will be punted until early 2025," according to Dodge.

Institutional Construction

Expected to grow 12 percent to $213 billion and square footage expected to increase 9 percent to 355 million square feet, the institutional construction market is being driven by airport, casino projects. A $2.55 billion project to redevelop Terminal B at George Bush Intercontinental Airport in Houston, for example, has boosted that segment.

Houston Airports employees tour the new TSA Recheck area inside the new International Central Processor at Bush Airport. The recheck area is a dedicated zone for international passengers entering the U.S., who will be screened by the TSA before boarding domestic flights.Houston Airport Systems

Houston Airports employees tour the new TSA Recheck area inside the new International Central Processor at Bush Airport. The recheck area is a dedicated zone for international passengers entering the U.S., who will be screened by the TSA before boarding domestic flights.Houston Airport Systems

Residential Building Construction

Dodge officials expect residential building to increase 10 percent this year to $406 billion, while single-family construction is expected to grow 12 percent to $259 billion. Multifamily will gain by 7 percent, but multifamily units are expected to decrease by 5 percent to 662,000.

"The fall in multifamily units when dollar value increases implies that the market will shift toward higher-end construction, which is different from what the housing sector currently needs, as it struggles with affordability for both potential owners and renters. Importantly, however, the housing market remains nearly 1.5 million units undersupplied, and this will provide tremendous impetus to build once interest rates turn more favorable," the report stated.

Manufacturing

Manufacturing starts are expected to rise 5 percent in dollar value to $81 billion in 2024 and 6 percent in square footage to 148 million square feet, according to Dodge.

"This year, manufacturing starts are expected to grow once again, just not at the pace seen immediately following the passage of the CHIPS and Inflation Reduction Acts," the report stated.

Manufacturing starts are expected to rise 5 percent in dollar value to $81 billion in 2024 and 6 percent in square footage to 148 million square feet, according to Dodge.@creativenature.nl - adobe.stock.com

Manufacturing starts are expected to rise 5 percent in dollar value to $81 billion in 2024 and 6 percent in square footage to 148 million square feet, according to Dodge.@creativenature.nl - adobe.stock.com

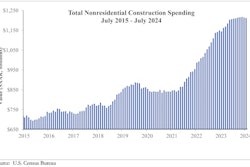

Commercial Construction

This segment likely will not see as much growth as nonbuilding and residential, but will increase at a rate of 2 percent. Dodge expects it to reach $155 billion this year, while square footage will likely pull back to 815 million square feet.

"After adding no new warehouse projects to their planning queue in 2023, Amazon has again begun to add plans for new warehouse projects in 2024," the report stated. "Since Amazon is a giant in the warehouse market, this change will significantly affect future warehouse construction. The office sector will also see a more positive outlook in 2024 thanks to the push for AI-capable data centers."