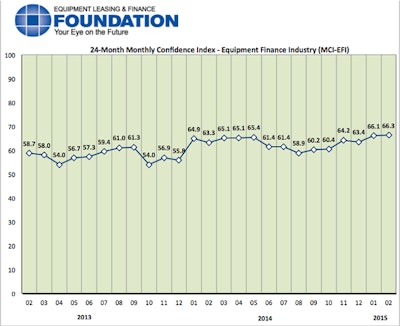

The Equipment Leasing & Finance Foundation's February 2015 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) reports that overall, confidence in the equipment finance market is 66.3, a slight increase from the three-year high level reached by the January index of 66.1.

When asked about the outlook for the future, MCI-EFI survey respondent William Verhelle, Chief Executive Officer, First American Equipment Finance, a City National Bank Company, said, “The economy continues to improve. First American is seeing increased equipment acquisition activity among the large corporate borrowers we serve. We are optimistic that lower energy costs, if they remain at current low levels, will drive increased U.S. economic activity in the second half of 2015. We are more optimistic about the U.S. economy today than we have been at any time during the past six years.”

February 2015 survey results

When asked to assess their business conditions over the next four months:

- 30.3% believe business conditions will improve, up from 23.3% in January

- 63.6% believe business conditions will remain the same, down from 76.7% in January

- 6.1% believe business conditions will worsen, up from none who believed so the previous month

- 42.4% believe demand for leases and loans to fund capital expenditures (capex) will increase, up from 20% in January

- 51.5% believe demand will “remain the same”, down from 80% the previous month

- 6.1% believe demand will decline, up from none in January

- 27.3% expect more access to capital to fund equipment acquisitions, down from 33.3% in January

- 72.7% expect the “same” access to capital to fund business, up from 66.7% in January

- None expect “less” access to capital, unchanged from the previous month

- 39.4% expect to hire more employees, a decrease from 50% in January

- 57.6% expect no change in headcount, up from 50% last month

- 3% expect to hire fewer employees, up from none who expected fewer in January

- 6.1% evaluate the current U.S. economy as “excellent,” up from 3% last month

- 90.9% of the leadership evaluate the current U.S. economy as “fair,” down from 97% in January

- 3% rate it as “poor,” up from none the previous month

When asked to assess conditions over the next six months:

- 45.4% believe that U.S. economic conditions will get “better”, an increase from 43.3% who believed so in January

- 54.6% believe the U.S. economy will “stay the same” over the next six months, down from 56.7% in January

- None believe economic conditions in the U.S. will worsen over the next six months, unchanged from last month

- 48.5% believe their company will increase spending on business development activities, a decrease from 50% in January

- 51.5% believe there will be “no change” in business development spending, an increase from 50% last month

- None believe there will be a decrease in spending, unchanged from last month