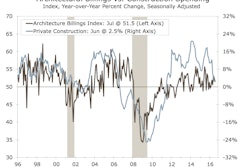

Led by a still active multi-family housing market and sustained by solid levels of demand for new commercial and retail properties, the Architecture Billings Index (ABI) has accelerated to its highest score in nearly a year. The American Institute of Architects (AIA) reported the May ABI score was 53.1, up sharply from the mark of 50.6 in the previous month. This score reflects an increase in design services (any score above 50 indicates an increase in billings).

“Business conditions at design firms have hovered around the break-even rate for the better part of this year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Demand levels are solid across the board for all project types at the moment. Of particular note, the recent surge in design activity for institutional projects could be a harbinger of a new round of growth in the broader construction industry in the months ahead.”

The new projects inquiry jumped 3.2 points from 56.9 in April to 60.1 in May. Design billings fell to 52.8 but remain in positive territory.

By sector, much of May's increase was due to a rebound in institutional billings, which moved out of contraction territory to 53 on the May ABI. Mixed-use billings also rose to a reading of 51. Residential remained flat at 53.7 while commercial/industrial slipped one point to 51.

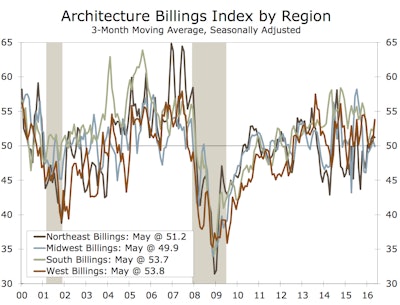

On a regional basis, the Midwest was the only region that fell into contraction territory at 49.9. The Northeast remained in positive territory with an ABI reading of 51.2. The West saw the largest increase of three points to 53.8 while the South jumped 1.5 points to 53.7.