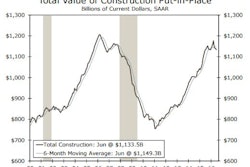

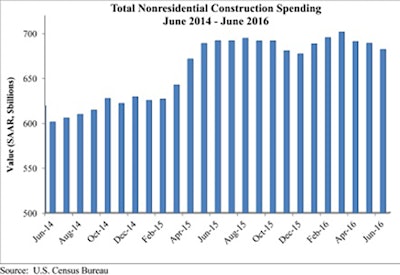

Nonresidential construction spending dipped 1% in June and has now contracted for three consecutive months according to Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data. Nonresidential spending, which totaled $682 billion on a seasonally adjusted, annualized rate, has fallen 1.1% on a year-over-year basis, marking the first time nonresidential spending has declined, relative to the same month in the previous year, since July 2013.

“On a monthly basis, the numbers are not as bad as they seem, as May’s nonresidential construction spending estimate was revised higher. However, this fails to explain the first year-over-year decline in nearly three years,” said ABC Chief Economist Anirban Basu. “There are many forces at work, most of them negative, with the noteworthy exception of construction materials prices, which are down on a year-over-year basis. To the extent that savings are being passed along to purchasers of construction services, spending would appear lower in dollar terms than when measured in physical terms such as square footage.

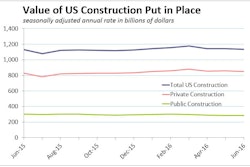

Tepid spending by public agencies also continues to shape the data. Despite a monthly pick-up in spending, water-supply construction spending is down 14% on a year-over-year basis. Public safety construction spending is down 8.4% from a year ago, sewage and waste disposal by nearly 15%, highway and street by about 6%, education by 4% and transportation by more than 3%.

“Though many contractors continue to report extensive backlog, the data suggest that average firm backlog may begin to retrench,” warned Basu. “The only significant driver of economic growth in America presently is consumer spending. Corporate profits remain stagnant and business investment remains underwhelming. Public sector spending does not appear positioned to accelerate anytime soon despite the passage of a federal highway bill last year.”