Ed Sullivan, chief economist with the Portland Cement Assoc., believes that the large year-over-year percentage gains in Portland cement consumption expected in early in 2011 will be a false read for the year's overall performance. Speaking at World of Concrete 2011, Sullivan said that while the severity of most conditions that put the U.S. into recession – subprime mortgages, high energy prices, tightening lending standards, and state deficits – has abated, the conditions themselves remain in place and can intensify.

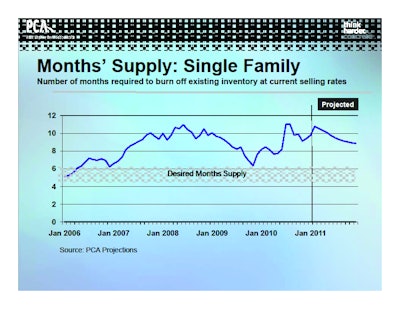

One construction-economy spoiler, despite the expected rally in the general economy, is mortgage foreclosures. For homebuilders to make their expected return on investment, there can be no more than about five months of inventory of homes for sale, and prices need to be stable, at least. Carrying costs eat into ROI and lower prices demand faster sales turnover to keep builders in the black.

Home foreclosures increase available inventory and depress prices. The current U.S. home inventory is projected to be 10 months at today's turnover rate. With one in four homes on the market in bank possession, and the end of foreclosures expected to be as far off as 2013, Sullivan doesn't expect significant home-building activity until 2013.