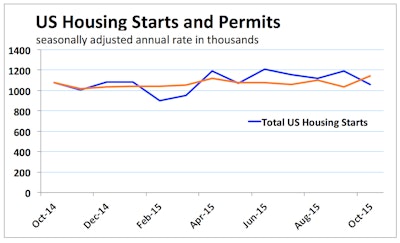

Permits to build new homes in the U.S. increased 4.1% in October to a seasonally adjusted rate of 1.15 million per year. Single-family and multifamily levels both increased, by 2.4% and 6.8% respectively. Year-to-date, total permits are up 11.9%; single-family are up 8.6% and multifamily are up 17.2% as the housing market continues its modest pace of recovery.

October U.S. housing starts dropped 10.9% primarily due to a 25.5% fall in multifamily activity (single-family starts were down 2.4% for the month). The correction was expected, as multifamily starts in September were significantly above trend.

Despite big month-to-month fluctuations, average starts for the three months ending in October were 9.6% greater than the average for August, September and October 2014. Both single-family and multifamily starts are doing significantly better than the August-to-October averages from 2014, 8.9% and 12.3%, respectively.

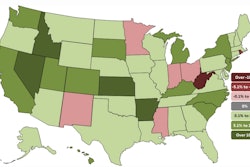

Three of the four census regions reported slight increases while single-family starts in the South were down 6.9%. The drop appears to be due to especially stormy weather throughout the southern coast in October. Year-to-date single-family sums are up across all regions as are single-family permits suggesting that the slight October drop is temporary.

The steady increase in residential starts in 2015 has produced a steady increase in the number of homes under construction although carrying them through to completion slowed a bit as labor shortages, especially for finishing carpenters, slow the ability to get finishing touches done.

The October report from Census and HUD provide nothing to change NAHB’s forecast for continued modest growth in 2015 and some slight acceleration in single-family construction in 2016 as the economy grows, jobs are added and mortgage rates remain relatively low.