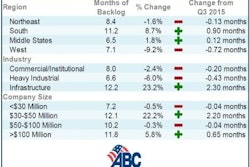

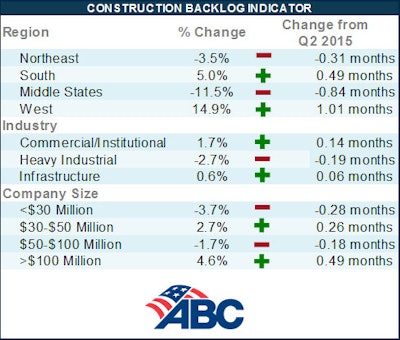

The backlog of commercial and industrial construction projects reached 10.3 months in the South, the highest reading in the history of the Construction Backlog Indicator (CBI), according to third-quarter results announced by Associated Builders and Contractors (ABC). Nationally CBI remained virtually unchanged at 8.5 for the quarter, although it has declined by 3.5% year-over-year, indicating that the nonresidential construction backlog has stabilized at a high level.

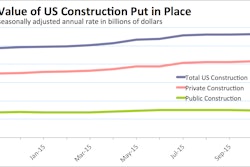

“Nonresidential construction remains one of the nation’s leading engines of economic growth,” said ABC Chief Economist Anirban Basu. “Industry spending is up 11 percent on a year-over-year basis, and the most recent backlog indicator strongly suggests that construction volumes will continue to recover. Unlike prior years, both the private and public sectors are now contributing to spending growth.

“While rapid economic growth continues to elude America, the economy has been strong enough to produce more than 2.6 million net new jobs over the past year,” said Basu. “Wage growth is poised to accelerate and residential markets continue to improve, with single family activity picking up recently and home prices continuing to edge higher in many communities. This implies ongoing support for commercial construction and stable tax collections or better, which ultimately translates into more public works projects.”

Regional readings

The South continues to be associated with large-scale projects that help drive the construction backlog higher. During the most recent CBI survey, the South recorded its highest level of backlog in history. In fact, in the history of the series, no region has posted as high a backlog reading as the South’s 10.3 months. Over the past year, the region’s backlog has lengthened by more than a month.

Backlog stands at 8.5 months in the Northeast, a bit higher than it was two years ago. The Northeast continues to be propelled by rebounding professional and financial services sectors. Many cities continue to wrestle with excess supply of office space, however, which has been suppressing new construction.

Led by rapidly expanding technology communities in California, Washington, Oregon and Utah, backlog in the West has expanded briskly over the past two quarters. Tesla’s new factory in Reno, Nev., has also begun to impact the data. Cities such as San Jose, Los Angeles, Seattle, San Francisco, Phoenix and Portland have all become more active, with permitting data suggesting that construction volume will remain elevated.

Predictably, dynamics are a bit different in the Middle States. Despite significant investment in components of the auto sector, including in industrial facilities, declines in commodity prices have dramatically reduced investment levels in states ranging from North Dakota to Ohio. Backlog in the Middle States now stands at 6.5 months, the lowest regional reading and a level not much different from the beginning of 2011.

Regional highlights

After a lull in backlog growth, many Louisiana contractors are indicating a surge in backlog associated with industrial projects. Commercial activity in Florida continues to expand in virtually every major city.

Despite a loss of momentum in energy-related investment, backlog in the Middle State continues to be supported by a host of other segments, including large-scale distribution centers, capital investment in automobile factories, and significant levels of healthcare- and medical research-related investment, including in cities like Grand Rapids.

The Northeast boasts the second highest CBI reading after the South, with public spending increasingly supporting activity in states like Maryland and Pennsylvania.

Technology companies continue to expand their physical footprint and to generate profound levels of new wealth. As a result, backlog in the West is now approaching 8 months.

Industry breakdown

Backlog has been stable or edging higher in each of the three industry categories monitored by ABC — commercial/institutional, heavy industrial and infrastructure.

Backlog in the infrastructure category stands at 9.9 months, better than the year ago level. This is notable following the rapid growth in backlog for infrastructure-oriented firms in 2014 as a number of states substantially increased their outlays. With indications of progress with respect to funding for the federal government’s Highway Transit Fund and the steadily improving finances of state and local governments, the outlook for this category is the best that it has been in several years.

Backlog in the heavy industrial category stands at 7.1 months despite the loss of investment momentum in the nation’s energy sector. This impressive resiliency is a reflection of the ongoing investment taking place in the nation’s manufacturing facilities as enterprises seek to install the latest technologies and perhaps to increase their respective capital to labor ratios.

Led by growth in healthcare, financial activities, hospitality and professional services, backlog in the commercial/institutional category stands at more than 8.2 months. Recent job growth has been concentrated in healthcare, professional services, retail and leisure/hospitality, suggesting growing demand for commercial space.

Industry highlights

For a second consecutive quarter, backlog in the heavy industrial category stood at more than 7 months. Prior to the last two quarters, backlog had never been above 7 months in the history of the CBI series.

For a 13th consecutive quarter, backlog in the commercial/institutional category stood at more than 8 months. Backlog in this category has not exceeded 9 months during the history of the series.

For a fifth consecutive quarter, infrastructure backlog stood above 9 months. It is likely that backlog will soon exceed the 10 month threshold.

Company size tends

In the aftermath of the global financial crisis, construction backlog grew most rapidly among the largest construction firms. These were often the firms that had the strongest balance sheets, the most stable insurance relationships, and the most capacity to take on additional work. With the maturing of the recovery, however, a rising number of firms has been participating in the recovery.

Backlog among firms with annual revenues between $30 million and $50 million has expanded for four consecutive quarters and now stands at 9.9 months. Backlog among firms with less than $30 million in annual revenues continues to remain above 7 months, which has been true for nine consecutive quarters. That said, the lengthiest backlog continues to be reported by the largest firms, with companies with more than $100 million in annual revenues collectively reporting a backlog approaching 11.2 months.

Highlights by company size

Firms of every size continue to be impacted and unnerved by skilled labor shortfalls. Without question, the lack of sufficient numbers of skilled craftsmen has helped to put a lid on CBI in recent quarters, with a growing proportion of firms turning away projects.

With the outlook for public infrastructure spending improving, backlog in the larger firm categories is likely to expand during the quarters ahead. Large-scale infrastructure projects tend to have high levels of large firm participation.

Over the past year, firms in the $30 million to $50 million annual revenue category have experienced the most improvement in average backlog. Six years ago, backlog among these firms stood at less than 5 months. It is now roughly double that.