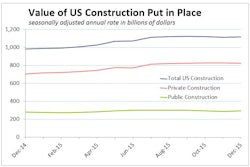

Nonresidential construction spending dipped for a second consecutive month, falling 0.4% on a monthly basis in December, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC). Nonresidential construction spending totaled $681.2 billion on a seasonally adjusted, annualized basis. November’s nonresidential construction spending estimate was revised lower by 0.6% to $683.7 billion.

For a second consecutive month, 12 of 16 nonresidential subsectors experienced spending decreases on a monthly basis. Private nonresidential spending dipped 2.1% for the month, while public sector spending expanded 2.2%.

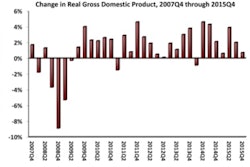

“December’s estimate is a bit unnerving not only because it represents a second consecutive month of spending decline but also because unusually warm temperatures should have helped to translate into better spending performance,” said ABC Chief Economist Anirban Basu. “A number of leading indicators suggest that nonresidential construction spending performance will remain choppy moving forward, both for the broader economy and the nation’s nonresidential construction segment, including the Baltic Dry Index, the Conference Board’s Index of Leading Economic Indicators and the Architecture Billings Index.

“This is not to suggest that the nonresidential recovery will end in the near term,” said Basu. “Most firms continue to report healthy backlog and hiring remains aggressive, implying that many firms are staffing up in order to perform on forthcoming contractual opportunities. However, private credit is beginning to tighten and becoming more expensive. Consumer delinquencies are edging higher and corporate bond defaults have been climbing. Accordingly, many contractors may experience a slowdown in backlog accumulation in 2016, with the 2017-2018 economic outlook remaining decidedly murky.”

Only four of 16 nonresidential construction sectors experienced spending increases in December on a monthly basis:

- Spending in the highway and street category expanded by 9.6% on a monthly basis and 11.7% on a yearly basis.

- Communication-related spending increased 4% month over month and 37.2% year over year.

- Sewage and waste disposal-related spending expanded 1.3% for the month, but fell 9.7% from the same time last year.

- Spending in the amusement and recreation category climbed 0.5% on a monthly basis and 9.2% on a year-over-year basis.

Spending in 12 of the nonresidential construction subsectors fell in December on a monthly basis:

- Spending in the power category fell 0.3% from November 2015, but is 7.6% higher than in December 2014.

- Commercial-related construction spending fell 0.6% for the month and 3.2% for the year.

- Educational-related construction spending fell 0.8% on a monthly basis, but expanded 10% on a yearly basis.

- Transportation-related spending fell 0.8% month over month, but expanded 2.3% year over year.

- Lodging-related spending was down 1.3% for the month, but is up 29.1% on a year-ago basis.

- Spending in the office category fell 1.8% from November 2015, but is up 16.6% from December 2014.

- Water supply-related spending fell 2.9% on a monthly basis and 6.6% on a yearly basis.

- Health care-related spending fell 3.2% month over month, but is up 0.4% year over year.

- Spending in the religious category fell 4.1% for the month and 1.7% for the year.

- Public safety-related spending declined 4.6% for the month and 7.4% for the year.

- Manufacturing-related spending fell 7.2% from November 2015, but is 19.6% higher than in December 2014.

- Conservation and development-related spending declined 9.9% on a monthly basis and is 8% lower on a yearly basis.