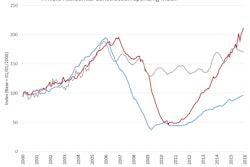

Builder confidence in the market for newly-built single-family homes fell three points to 58 in February from an upwardly revised January reading of 61 on the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). The HMI is still well above the tipping point of 50 and three points above last February but down from a recent peak of 65 in October 2015.

“Though builders report the dip in confidence this month is partly attributable to the high cost and lack of availability of lots and labor, they are still positive about the housing market,” said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, IL. “Of note, they expressed optimism that sales will pick up in the coming months.”

“Builders are reflecting consumers’ concerns about recent negative economic trends,” said NAHB Chief Economist David Crowe. “However, the fundamentals are in place for continued growth of the housing market. Historically low mortgage rates, steady job gains, improved household formations and significant pent up demand all point to a gradual upward trend for housing in the year ahead.”

NAHB’s forecast is for a return to more normal, albeit modest, growth in the US as consumers continue to catch up to past patterns, as employment continues to grow and as mortgage rates remain near historic lows. The HMI continues to track new home sales and both have been on an upward trajectory for several years.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as "good," "fair" or "poor." The survey also asks builders to rate traffic of prospective buyers as "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI component measuring sales expectations in the next six months rose one point to 65 in February. Builders are expecting the consumer to gain some confidence and return in greater numbers in the future.

The index measuring current sales condition fell three points to 65, and the component charting buyer traffic dropped five points to 39.

Looking at the three-month moving averages for regional HMI scores, all four regions registered slight declines. Weather did not appear to have a large impact in either direction. While the Northeast and Mid-Atlantic suffered significant snow in January, the regional indicators (to the extent they reflect similar geographies) showed no worse decline than the regions without significantly different weather patterns than the norm.

The Midwest fell one point to 57, the West registered a three-point drop to 72 and the Northeast and South each posted a two-point decline to 47 and 59, respectively.