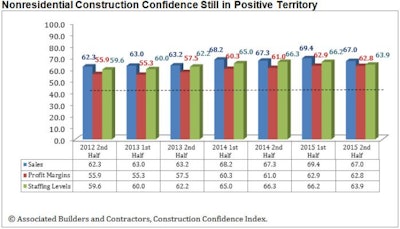

Associated Builders and Contractors’ (ABC) Construction Confidence Index (CCI) showed a slight dip in the second half of 2015, although all three components of the index showed optimism for continued economic growth. The diffusion index measures forward-looking construction industry expectations in sales, profit margins and staffing levels, with readings above 50 indicating growth.

- Sales expectations fell from 69.4 to 67.0

- Profit margin expectations edged lower from 62.9 to 62.8

- Staffing level intentions dipped from 66.2 to 63.9.

“An abundance of considerations have rendered the typical nonresidential construction executive somewhat less confident regarding near-term business prospects,” said ABC Chief Economist Anirban Basu. “These include jittery financial markets, stubbornly low commodity prices, unpredictable Federal Reserve policy and rising consumer delinquencies and corporate defaults. Outside of financial concerns, the industry is concerned by skilled construction worker shortages, the unpredictable presidential election cycle and expanding geopolitical risk. Still, construction executives collectively expect nonresidential construction’s impressive recovery to persist, in large measure because backlog remains high.

“A number of key nonresidential construction segments continue to blossom, including hotels, data centers, outpatient centers, industrial facilities, education and power,” said Basu. “While a handful of states are now in recession (including North Dakota, Alaska, West Virginia and Wyoming), most of the nation continues to experience ongoing recovery. Consumer spending growth continues to lead the way. Exports have sagged, however, and business investment remains tepid. The most optimistic data continues to be associated with the labor market. The nation continues to add better than 200,000 jobs per month on average and unemployment is down to 5%. The recent uptick in labor force participation also supplies reason to believe in near-term economic expansion and construction continues to generate a disproportionate share of the nation’s net new jobs.

“Still, construction executives are well aware that the business cycle can end abruptly,” warned Basu. “Asset prices continue to be unsettled and credit availability could tighten going forward if markets remain wobbly. The direction of interest rates is naturally of enormous concern to construction leaders since real estate and construction are among the sectors most sensitive to shifts in the cost of capital and the availability of financing.”