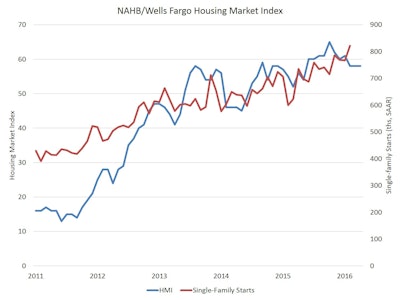

Builder confidence in the market for newly-built single-family homes remained unchanged in April at a level of 58 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Builder confidence has held firm at 58 for three consecutive months, showing that the single-family housing sector continues to recover at a slow but consistent pace,” said National Association of Home Builder's (NAHB) Chairman Ed Brady, a home builder and developer from Bloomington, IL. “As we enter the spring home buying season, we should see the market move forward.”

NAHB is forecasting faster single-family construction growth for 2016 than the 10% gain recorded in 2015.

“Builders remain cautiously optimistic about construction growth in 2016,” said NAHB Chief Economist Robert Dietz. “Solid job creation and low mortgage interest rates will sustain continued gains in the single-family housing market in the months ahead.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as "good," "fair" or "poor." The survey also asks builders to rate traffic of prospective buyers as "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI components measuring sales expectations in the next six months rose one point to 62, and the index gauging buyer traffic also increased a single point to 44. Meanwhile, the component charting current sales conditions fell two points to 63.

Looking at the three-month moving averages for regional HMI scores, all four regions registered slight declines. The Northeast and West each fell two points to 44 and 67, respectively. Meanwhile, the Midwest and South each posted respective one-point losses to 57 and 58.