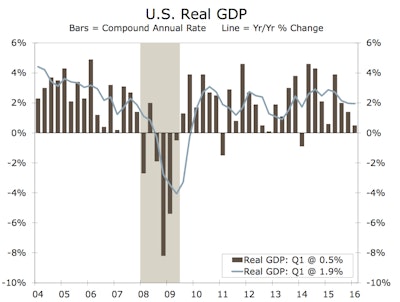

Real gross domestic product (GDP) expanded only 0.5% (seasonally adjusted annual rate) during 2016’s first quarter according to an Associated Builders and Contractors (ABC) analysis of Bureau of Economic Analysis data. Real GDP has been on a downward slide since the second half of 2015, and the past three first quarters have registered progressively lower rates.

This disappointing figure follows a 1.4% annualized rate of economic output expansion during the fourth quarter of 2015.

Nonresidential fixed investment struggled with a 5.9% decline during the year’s first three months after falling 2.1% during 2015’s final quarter. It was the segment's largest decline since the second quarter of 2009. Nonresidential fixed investment in structures fared particularly poorly, declining 10.7% during the first quarter on an annualized basis while nonresidential investment in equipment fell 8.6%.

“Aside from consumer spending growth, state and local government spending growth and residential building, very little expanded in America during the first three months of 2016,” said ABC Chief Economist Anirban Basu. “It is quite conceivable that the current U.S. economic expansion will end before the economy registers a 3% or better rate of growth for a single calendar year. The last time the U.S. economy expanded more than 3% was in 2005, when the economy expanded 3.4%.”

“Corporate profitability has been slipping in recent quarters and the mergers and acquisition marketplace has heated up, an unfavorable sign for nonresidential contractors,” said Basu. “Many corporate CEOs continue to use available cash to purchase competitors either to gain access to product pipelines, thereby diminishing required product development expenses, or to generate cost savings by eliminating duplicative functions. The result is a lack of business investment generally and a slowing pace of private nonresidential construction spending growth. If it not for an enormous amount of foreign money coming to our shores, private nonresidential construction growth would have been even softer in early 2016. While falling energy-related investment and seasonal factors represent important parts of the story, there are indications of a broader malaise.”

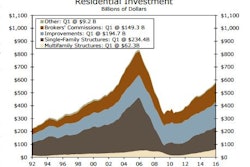

Residential investment recorded its second consecutive double-digit gain with a 14.8% increase, reflecting the continued positive momentum of the housing recovery.

The following segments highlight the first quarter GDP release:

- Personal consumption expenditures rose 1.9% on an annualized basis during the first quarter of 2016 after growing 2.4% during the fourth quarter of 2015.

- Spending on goods inched 0.1% higher during the first quarter after expanding by 1.6% during the fourth quarter.

- Real final sales of domestically produced output increased 0.9% in the first quarter after rising 1.6% in the fourth.

- Federal government spending fell by 1.6% in the year’s first quarter after expanding 2.3% in the fourth quarter of 2015.

- Nondefense spending increased by 1.5% in both the first quarter of 2016 and the fourth quarter of 2015.

- National defense spending fell by 3.6% in the fourth quarter after registering a 2.8% increase in the previous quarter.

- State and local government spending increased by 2.9% in the first quarter after falling 1.2% during the prior quarter.

According to Wells Fargo Securities, a GDP rebound is expected in the second quarter thanks to solid employment gains and a firming rate of real income growth (3% year over year). Drags from trade and inventory reductions will likely remain but to a lesser degree. Business fixed investment remains the wild card. Wells Fargo Securities expects a 2.3% growth for GDP in the second quarter and a 2.5% growth for the second half of the year (the average of GDP growth rates in Q2 - Q4 of 2014 was 3.7%; in 2015 it was 2.4%).