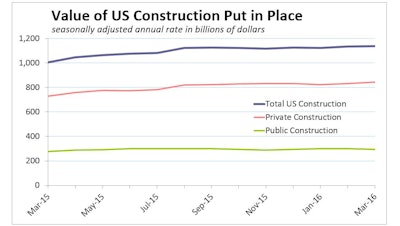

The total value of U.S. construction put in place rose 0.3% in March to a seasonally adjusted annual rate of $1,137.5 billion, from an upwardly revised estimate of $1,133.6 billion in February. Overall construction spending rose 8.0% relative to a year earlier on the back of strong readings in private construction spending and public nonresidential.

The average of total construction spending rates in the first quarter was 14.7% greater than the average of January, February and March readings form 2015.

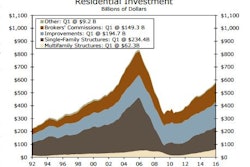

Total residential spending grew 1.5% from the February level, and the average of Q1’s annualized spending rates on residential construction was 14.3% greater than in Q1 of 2015.

Single-family outlays, which comprise more than half of overall residential spending, were unchanged during the month, while multifamily rose 5.6%. Public residential spending fell 0.4% in March registering its fifth straight decline.

Despite a gradual rise in the apartment vacancy rate, the sector remains resilient. Spending in March on multifamily construction was 34.6% higher than March of 2015. Monthly multifamily sending readings have grown for five consecutive months.

“We also continue to see a tremendous amount of pent-up demand from young adults still living at home,” said the Wells Fargo Economics Group’s analysis of the monthly construction-put-in-place report, “Suggesting that even if we see some moderation in activity, there is still room to grow in this sector.”

After three consecutive monthly declines, private nonresidential outlays rose 5.0% in March. Healthcare, lodging, manufacturing, commercial, transportation and communication led the way, while office, education, and power contracted during the month.

Lodging was an early outperformer in this cycle, with hotel demand growth surging, occupancy reaching an all-time high and real revenue-per-available-room growth also seeing strong gains. Private-sector spending on lodging construction rose 1.6% in March, and is 28.8% higher than March of 2015. But Wells Fargo warns that activity in the lodging sector is beginning to soften.

“We suspect occupancy peaked last year and growth in the real average daily rate (ADR) is moderating,” according to Wells Fargo.

Manufacturing has been another strong outlier during this cycle on the back of chemical and transportation equipment manufacturing. Both components advanced during the month, lifting manufacturing-construction spending in March 2.2%. But manufacturing construction is down 2.0% compared to March 2015, with chemical manufacturing falling 4.5% year over year. Transportation equipment provides a counterbalance, up almost 15% from a year earlier.

The nominal level of overall construction spending is just 13% off its prerecession peak.

“Private nonresidential spending should continue to show broadly based gains in the coming months consistent with improvement in the labor market,” Wells Fargo says. “Private nonresidential is also expected to continue to rise this year.”

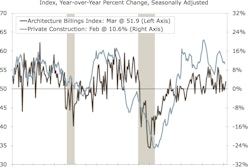

The American Institute of Architects' Architecture Billings Index, which reflects design work on private nonresidential projects (which should be constructed within nine to 12 months), remains in expansion territory.