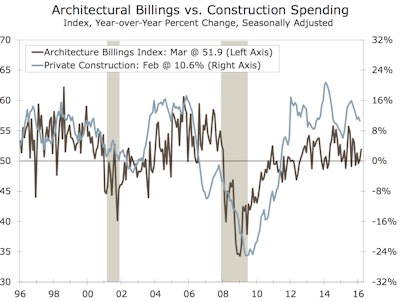

The American Institute of Architects (AIA) reported the March ABI score was 51.9, up from the mark of 50.3 in the previous month. Weakness seen in the first month of the year appears to be transitory. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The Architecture Billings Index reflects consecutive months of increasing demand for design activity at architecture firms. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to 12 month lead time between architecture billings and construction spending.

The new projects inquiry index was 58.1, down from a reading of 59.5 the previous month.

“The first quarter was somewhat disappointing in terms of the growth of design activity, but fortunately expanded a bit entering the traditionally busy spring season. The Midwest is lagging behind the other regions, but otherwise business conditions are generally healthy across the country,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “As the institutional market has cooled somewhat after a surge in design activity a year ago, the multifamily sector is re-accelerating at a healthy pace.”

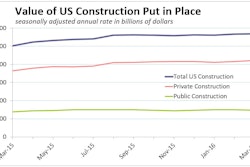

According to Wells Fargo Securities, as we get deeper into the spring season, we should expect nonresidential outlays to improve further but at a more modest pace.

Key March ABI highlights:

Regional averages:

- South (52.4)

- Northeast (51.0)

- West (50.4)

- Midwest (49.8)

Sector index breakdown:

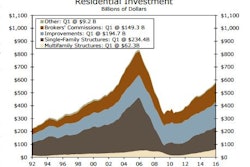

Multifamily billings are starting to pick up steam with a 2.7 point rise in March. Institutional billings contracted in the first quarter and spending for this sector has also moderated. After four straight months below the critical threshold, mixed billings has finally rebounded, rising 2.3 points in March.

- multifamily residential (55.7)

- commercial/industrial (51.8)

- mixed practice (50.0)

- institutional (48.0)

Project inquiries index: 58.1

The regional and sector categories are calculated as a 3-month moving average, whereas the national index, design contracts and inquiries are monthly numbers.