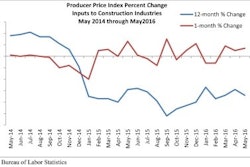

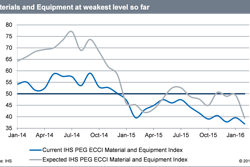

Construction costs almost hit the neutral mark in July, according to according to IHS Markit and the procurement Executives Group (PEG). The headline current IHS PEG Engineering and Construction Cost Index registered 49.8 this month, up from 48.1 in June. The headline index has been consistently below the neutral mark for past the 19 months. An uplift in materials and equipment prices was not enough to shift the pricing environment higher, due to lower escalation in labor costs.

This month, the current materials/equipment price index rose above the neutral mark for the first time since December 2014. The sub-index registered 50.5 in July, indicating rising prices. Out of the twelve categories, only four showed falling prices: two ocean freight indices as well as exchangers and pumps. The previous two months' price increases in steel began to show up in carbon steel pipe and alloy steel pipe.

"Pipe suppliers are trying hard to raise prices on the back of sharply higher sheet and scrap prices. However, they are having limited success in doing so due to a combination of weak demand and high inventory levels,” said Amanda Eglington, senior economist at IHS Pricing and Purchasing. “Carbon steel pipe products are seeing more upward pressure than alloy or stainless pipe and welded pipe is outperforming seamless. Sheet prices are forecast to decline over the second half of the year and will temper the rebound in pipe prices during that same period."

The current subcontractor labor index fell once again in July. Despite a slight increase over last month's index figure, the sub-index has recorded its third consecutive month below the neutral mark, at 48.2. In the U.S., labor costs were unchanged from last month in the Northeast and South. The Midwest registered soft prices, while the West recorded mostly rising labor costs. In Canada, labor costs for Western regions fell. They were mostly unchanged from June in Eastern regions. The downturn in the oil and gas market continues to apply downward pressure on wages despite a relatively tight labor market.

The six-month headline expectations index showed higher prices. The index moved up from 49.4 in June to 51.3 in July. The materials/equipment index rose from 49.0 to 52.1 this month. Two components showed softer pricing, three were neutral, and seven showed rising prices. After a reversal last month, price expectations for the material/equipment index are back in growth territory.

Subcontractor labor price expectations been volatile since February, changing between expansion and contraction each month; July was no different. Labor costs are expected to be lower, at 49.4, moving down from 50.5. While the U.S. South showed stronger price expectations, prices in the U.S. Northeast and U.S. West were unchanged. Prices fell in the U.S. Midwest, once again. In Canada, labor costs for Eastern regions were mostly unchanged relative to last month and in Western regions, labor costs fell.

In the survey comments, some respondents have noted increased activity in the last few months. Nevertheless, the slow proposal environment, especially in the oil and gas sector, continues to be highlighted.

To learn more about the new IHS PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.