Current construction costs fell in April, according to a new report from IHS Inc. and the Procurement Executives Group (PEG). The headline current IHS PEG Engineering and Construction Cost Index (ECCI) registered 48.5 this month, up from 44.6 in March. The headline index has been consistently below the neutral mark for 16 months.

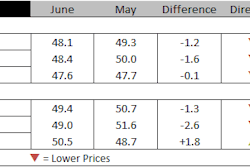

The current materials/equipment price index showed some improvement again, moving up from 41.8 in March to 47.5 in April. Although this sub-index has been registering falling prices for more than a year, it is now closer to the neutral mark. Similar to the index performance in March, this month's improvement in materials and equipment index is driven by an increase in a majority of underlying components. Nevertheless, only two materials posted rising prices and three materials registered neutral pricing. Despite the higher index figures, the remaining seven materials prices are still falling.

“Although commodity prices look exposed because of the lack of real improvement in fundamentals, their recent rally has been impressive and has continued into the second quarter,” said John Mothersole, director of research, IHS Global Insight, Pricing and Purchasing, “While we do see a choppy pricing pattern immediately ahead, the first quarter marked a definitive bottom in the current cycle. More importantly, price increases downstream in supply chains will begin to be seen in the second half of the year.”

The current subcontractor labor prices rose in April. However, the index figure continued to retreat, declining from 51 in March to 50.8 in April. The sub-index figure has been above the neutral mark for the last six months, although it has been decreasing in the last four, indicating that the industry is seeing less pressure from labor costs.

In the United States, the South and West registered rising prices for subcontractor labor, while prices were unchanged in Midwest and Northeast. In Canada, labor costs for both Western and Eastern regions fell from the previous month, bringing down the overall labor component.

The six-month headline expectations index rose sharply from to 51.4 in April from 44.1 in March. The materials/equipment index rose from 42.3 in March to 50 this month. Four categories came in above the neutral mark, four were neutral and four showed softer price expectations.

Overall expectations for materials and equipment moved into neutral territory after falling for four months. After last month's dip, expectations for labor costs increased to 54.5. Respondents anticipate subcontractor labor costs to rise in all regions of the United States. In both Western and Eastern Canada, labor prices are expected to fall.

In the survey comments, respondents note a healthy supply of materials and some note that commodity prices have bottomed out. Despite higher April figures, capital expenditure projects continue to experience challenges due to sluggish activity.