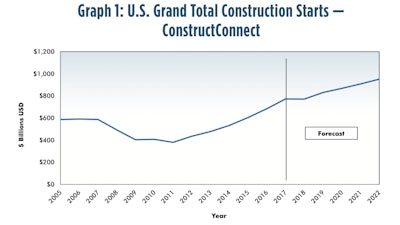

ConstructConnect, a leading provider of construction information and technology solutions in North America, announced today the release of its Fall 2018 Forecast and Quarterly Report. The forecast revealed minor revisions to its total construction starts from what was originally estimated last quarter. Total starts for 2018 over 2017 are now expected to be -0.2%, down slightly from the 0.4% figure previously calculated.

Single-family homebuilding will provide the major momentum this year and for the next several years. Multifamily residential groundbreakings will ease back in 2018, before resuming upward movement in 2019.ConstructConnect

Single-family homebuilding will provide the major momentum this year and for the next several years. Multifamily residential groundbreakings will ease back in 2018, before resuming upward movement in 2019.ConstructConnect

After a one-third increase in the 2017 starts, multifamily residential groundbreakings will ease back in 2018, before resuming upward movement in 2019 and beyond. Single-family homebuilding will provide the major momentum this year and for the next several years.

The demographics for single-family housing are encouraging, as family formations among millennials are spurring the desire for living space that transcends rental accommodation.

The forecast, which combines ConstructConnect's proprietary data with macroeconomic factors and Oxford Economics' econometric expertise, highlighted several favorable indicators:

- Single-family housing

- Petrochemical and liquified natural gas plants

- Airport expansions

- Energy-related pipeline projects

"The incentives to carry out capital spending at this time include numerous positive indicators: strong GDP growth accompanied by exceptional jobs creation and an almost record-low unemployment rate; a big cut in the tax rate and a bonus depreciation rate that are lifting corporate profitability; and a pervasive shift to rosier consumer and business confidence," explained ConstructConnect's Chief Economist Alex Carrick.

Nonresidential building starts fell by 3.4% year-on-year, but there were significant differences between the subsectors.ConstructConnectThe report indicates three economic concerns:

Nonresidential building starts fell by 3.4% year-on-year, but there were significant differences between the subsectors.ConstructConnectThe report indicates three economic concerns:

- Escalating inflation and rising interest rates

- U.S. dollar climbing in value

- Worries over tariffs and possible trade wars

The forecast's regional projections revealed in 2019 Texas and Florida will have the largest percentage increases, with New York and California performing well.