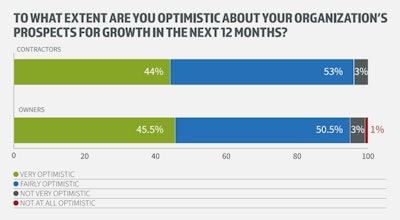

Construction technology company InEight has released the results of its annual report, which provides an economic outlook of the industry. The second annual "Global Capital Projects Outlook" reports that 99% of of North American capital project and construction professionals are optimistic about their organization’s future. That's up from 97% in 2021.

Digital technology is the top driver of growth but change management must improve for successful transformation, the report also states.

The report draws insights from research conducted with 300 of the world’s largest capital project owners and contractor construction professionals across North America, Europe and Asia (APAC). All respondents work in construction, although the report included those working in construction roles within broader industries, including: manufacturing, mining, computer services, transport, telecommunications, health services, government and more. Respondent surveys took place in March 2022.

Since that time, several organizations have reported waning optimism for construction industry profitability in 2022, due to increased inflation, raw materials prices, continued supply chain problems and the perennial workforce shortage.

RELATED:

- Study: Construction Companies Shifting Pricing Models to Reflect Inflation

- Construction: What if There's a Recession?

- Lumber Products Adding $14K to House Prices, $51 to Rent Since Pandemic

“Encouraged by record planned infrastructure investment in North America, everyone we speak to is talking about growth opportunities for both owners and contractors," Jake Macholtz, CEO, InEight, said about the report results. "The optimism, resilience and confidence of the industry is almost tangible it’s so strong. This is especially promising given the economic backdrop that organizations are operating within, the difficulty in breaking away from the past, and the challenge of digital transformation. However, it’s also the prospect of leveraging digital technologies to build a better world that is keeping spirits high.”

North American respondents reported a significant increase in construction and capital projects spending (up from 61% last year to 75% in 2022).

Different from last year's results, the report states, is the completion of projects on time and on budget, which has fallen dramatically (-23% and -26% respectively). An inability to see current project status and data at a detailed level (54% vs a 47% global average) was reported as a key influence on North American respondents’ project performance.

“Many projects become late and over budget because of poor planning, not poor execution," Macholtz said. “Many organizations lack rich, real-time data on project performance and progress, so they are repeatedly blindsided by unmanaged or unexpected risks and miss opportunities to make smarter decisions.”

Shifting to Digital

According to the report, digital technologies (54%) offer the top opportunity for growth, although almost all (95%) North American respondents said that their experience of change management left room for improvement, signaling a need for a more sophisticated, human-centric approach to technology implementation.

Tracking the global sentiment, North American respondents identified uneven or sporadic implementation (55%), process and data integration issues (54%) and technical and system limitations (49%) as the top frustrations caused by technology upgrades. North American respondents were also most likely to say that legacy ways of working prevent them from adopting new tools and processes in comparison to other regions (52% vs a 46% average).

The report found that respondents see digital technology as broadly helpful in their day-to-day roles, particularly, having reassurance of environment, health and safety (EHS) policy adherence (56%) and gaining detailed and holistic information on projects and events (53%).

However, highlighting the need for a human-centric approach, 92% of North American respondents said they had concerns about the future of digital transformation. Reduced in-person communication (45%), increased difficulty in understanding site/project reality (43%), and professional experience and human intuition being replaced by technology (35%) were all cited, reflecting similar concerns to their global peers.

When asked what benefits they hoped digital transformation could deliver in future, North American respondents said greater strategic insights (49%), more automation (46%), better communication (46%) and more control (44%) were all on the wish list.

“Respondents are clear on the benefits of digital technologies and eager to realize this new vision of the future but right now we are falling short when it comes to managing organizational change, making digital transformation unnecessarily arduous.” Macholtz said.

Read the report here.