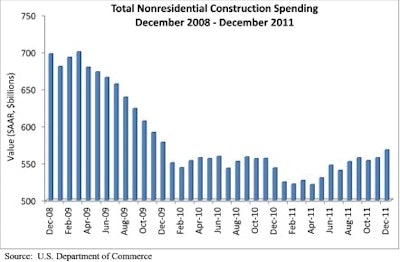

Ending 2011 on a relatively strong note, total nonresidential construction spending increased 1.9 percent in December to $567.8 billion, according to the February 1 construction spending report by the U.S. Census Bureau. Year over year, total nonresidential construction spending is up 4.5 percent.

Private nonresidential construction spending jumped 3.3 percent for the month and was up 11.4 percent from the same time last year. Public nonresidential construction spending increased 0.5 percent from November but was down 1.8 percent from December 2010.

Ten of the 16 nonresidential construction subsectors posted increases in spending for the month. The largest gains came in manufacturing, up 13.4 percent; communication, 6.6 percent higher; and power, up 2.7 percent. Six nonresidential construction subsectors experienced increases in spending during a 12-month period. These include manufacturing, up 44.2 percent; commercial, up 14 percent; power, 11.7 percent higher; education, up 4.4 percent; public safety, up 3.3 percent; and highway and street construction, 2.4 percent higher.

In contrast, construction subsectors posting the largest monthly decreases in spending include lodging, down 2.3 percent; public safety, 1.9 percent lower; and amusement and recreation, down 1.5 percent. Subsectors with the largest year-over-year decreases in spending include religious, down 19.4 percent; lodging, 15.2 percent lower; transportation, down 9.8 percent; and conservation and development-related construction, down 9 percent.

Residential construction spending inched up 0.7 percent in December and was up 3.8 percent year-over-year. Overall, total construction spending - which includes both nonresidential and residential - rose 1.5 percent for the month and was up 4.3 percent compared to December 2010.

"The nonresidential construction industry ended 2011 on a reasonably strong note," said Associated Builders and Contractors Chief Economist Anirban Basu. "While a number of key segments remain recessed, that weakness was predictable.

"Construction segments associated with state and local spending continue to struggle - not surprising given the ongoing economic stress on local government finances," Basu said. "The winding down of the federal government's 2009 stimulus package also likely plays a role in the poor performance of segments such as conservation and development and transportation.

"Certain private construction segments also continue to struggle, most notably lodging, in which spending fell 15.2 percent during the past year and was down 2.3 percent for the month," said Basu. "On the other hand, manufacturing rose again in December, this time by 13.4 percent. The subsector is up 44.2 percent for the year.

"Of all the segments, the ongoing expansion in construction related to energy appears to be the most peculiar," Basu said. "Energy companies continue to search for ways to increase domestic production, and energy continues to create construction activities despite a myriad of issues including low natural gas prices and shaky financing conditions with respect to nuclear energy.

"With certainty, we can predict a continuing expansion in private construction segments and stagnant to deteriorating spending in public categories in the months ahead," said Basu.