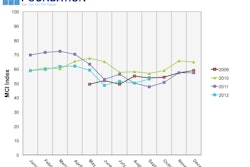

The Equipment Leasing & Finance Foundation (the Foundation) released the October 2012 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market is 53.3, relatively unchanged from the September index of 53, reflecting steady industry confidence despite economic, political and regulatory concerns.

Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $628 billion equipment finance sector.

When asked about the outlook for the future, MCI survey respondent Harry Kaplun, President, Frost Equipment Leasing and Finance, said, “Near term, results will continue to be strong. In the longer term, significant variables like accounting rules, depreciation rates and cost of funds will change the landscape.”

When asked to assess their business conditions over the next four months, respondents said:

- 8.6% believe business conditions will improve, relatively unchanged from 8.8% in September

- 74.3% believe business conditions will remain the same, up from 73.5% in September

- 17.1% believe business conditions will worsen, down from 17.6% the previous month

- 20% believe demand for leases and loans to fund capital expenditures (capex) will increase, an increase from 11.8% in September

- 57.1% believe demand will "remain the same," down from 76.5%

- 22.9% believe demand will decline, up from 11.8%

- 20% expect more access to capital to fund equipment acquisitions, up from 14.7% in September

- 80% expect the same access to capital, a decrease from 85.3%

- No survey respondents expect less access to capital, unchanged from September

- 34.3% expect to hire more employees, up from 29.4% in September

- 57.1% expect no change in headcount, down from 67.6% last month

- 8.6% expect fewer employees, up from 2.9%

- 65.7% evaluates the current U.S. economy as “fair,” down from 76.5% last month

- 34.3% rate it as “poor,” up from 23.5%

Over the next six months:

- 8.6% believe that U.S. economic conditions will get “better” over the next six months, up from 5.9% in September

- 77.1% believe the U.S. economy will "stay the same," down from 79.4% in September

- 14.3% believe economic conditions in the U.S. will worsen, a decrease from 14.7%

- 37.1% believe their company will increase spending on business development activities, up from 29.4% in September

- 62.9% believe there will be “no change” in business development spending, down from 70.6%

- No one believes there will be a decrease in spending, unchanged from last month