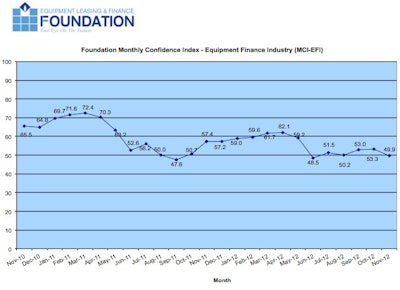

The Equipment Leasing & Finance Foundation (the Foundation) released the November 2012 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Overall, confidence in the equipment finance market is 49.9, a decrease from the October index of 53.3, reflecting many industry participants’ post-election concerns over issues including the fiscal cliff, economic policy and taxes. A confidence level of 50 indicates a neither positive nor negative outlook overall.

“The business community is waiting for positive signals from Washington before making additional investments," said MCI survey respondent Thomas Jaschik, President, BB&T Equipment Finance. "Investments in capital equipment and equipment financing will remain stagnant until such time.”

November 2012 survey results

Business conditions over the next four months

- 9.1% believe business conditions will improve, up from 8.6% in October

- 69.7% believe business conditions will remain the same, down from 74.3% in October

- 21.2% believe business conditions will worsen, up from 17.1% the previous month

Demand for leases and loans to fund capital expenditures (capex)

- 12.1% believe demand will increase, a decrease from 20% in October

- 63.6% believe demand will remain the same, up from 57.1% the previous month 24.2% believe demand will decline, up from 22.9% in October

Access to capital to fund equipment acquisitions

- 21.2% expect more access to capital, up from 20% in October

- 72.7% expect the same access to capital, a decrease from 80% the previous month

- 6.1% expect less access to capital, up from no one who expected less access to capital in October

Hiring more employees

- 33.3% expect to hire more employees, down from 34.3% in October

- 54.5% expect no change in headcount, down from 57.1% last month

- 12.1% expect fewer employees, up from 8.6% in October

U.S. economy evaluation

- 78.8% evaluates the current U.S. economy as “fair,” up from 65.7% last month

- 21.2% rate it as “poor,” down from 34.3% in October

- 6.1% believe U.S. economic conditions will get“better over the next six months, down from 8.6% in October

- 66.7% believe the U.S. economy will stay the same, down from 77.1% in October

- 27.3% believe economic conditions in the U.S. will worsen, an increase from 14.3% who believed so last month

Spending during the next six months

- 27.3% believe their company will increase spending on business development activities, down from 37.1% in October

- 63.6% believe there will be no change in business development spending, up from 62.9% last month

- 9.1% believe there will be a decrease in spending, up from no one who believed so last month

Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $628 billion equipment finance sector.