The liquidation of copper inventories among Chinese manufacturers is having a major impact on the opposite side of the Pacific, contributing to a slowdown in materials cost increases in the North American construction industry this month, according and the Procurement Executives Group (PEG).

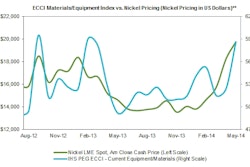

The materials/equipment component of the IHS PEG Engineering and Construction Cost Index (ECCI) declined to 51.5 percent in March, down from 55.2 percent in February. This represents the lowest level recorded so far in 2014.

Combined with a decline in the labor portion of the index, the headline IHS PEG ECCI decreased to 52.5 in March, down from 55.9 in February. While any reading above 50 still indicates that costs are rising, the drop in the ECCI indicates that increases are not as widespread. The ECCI now has been above 50 for 26 consecutive months.

Illustrating the broad nature of the deceleration, nine of the 12 subcomponents within the materials/equipment portion of the ECCI experienced a softening in price increases compared to the previous month. However, equipment based on copper experienced outright decreases, disproportionately pushing down the overall index.

"The PEG copper wire and cable index dropped in March, reflecting the shift in copper pricing and market conditions," said John Mothersole, research director of the Pricing and Purchasing Service at IHS. "Prices had been falling due to concerns about Chinese market growth. However, pricing is being driven down further by the potential liquidation of copper inventory accumulated in China during the past year."

Spot market pricing for copper on the London Metal Exchange declined by 3 percent in January, by 1 percent in February and by 8 percent through March 18.

China’s copper conundrum

Chinese manufacturers over the years have built large stockpiles of copper to use as collateral to fund other investments. However, tightening credit conditions are undercutting the attractiveness of these so-called copper financing deals, releasing copper back into the market. As this phenomenon progresses and as China’s manufacturing sector continues to slow down, selling pressure on copper is impacting a number of industries globally, including North American construction.

Soft labor

The other segment of the ECCI — the subcontractor labor index — also is showing some signs of softness. The labor index registered 54.7 percent in March, down 2.9 points from last month.

“While slightly softer, the labor index continues to reflect the strengthening picture of labor costs resulting from the energy boom in North America,” said Laura Hodges, director of the Pricing and Purchasing Service at IHS. “Western Canada continues to post the highest index levels of any region, indicating that a greater proportion of the survey population is observing higher prices. Construction companies are also expressing concern over tightness in skilled labor markets, particularly welders, in the US Gulf Coast region.”