FMI released its 2015 U.S. Markets Construction Overview which predicts 2014 will end with approximately 7 percent growth in construction put in place (CPIP). This rate of growth is expected to continue with a total CPIP of $1.04 trillion in 2015.

The overview consists of three sections: a synopsis of the key energy market trends impacting the construction industry, industry sector challenges and a detailed economic forecast.

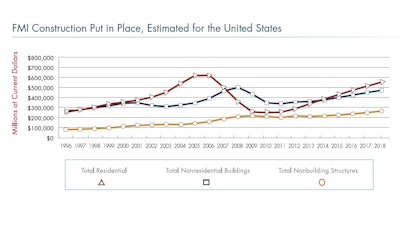

According to the Overview, FMI does not expect construction put in place to reach prerecession levels until sometime in 2017. Predictions also do not show government spending picking up significantly in the near term. FMI predicts sectors like power, conservation and development, and transportation will see growth ahead of GDP, but other sectors like water supply, sewage and waste disposal, and highway and street will be weak. Health care and education construction will also continue to struggle. Lodging is making a strong comeback, which FMI predicts will moderate by 2016. Office construction is also showing signs of growth.

The forecast for residential construction is strong with expected growth of 14 percent for 2015 and slightly lower through 2018. Multifamily construction has an expected growth of 13 percent in 2015.

The predictions for commercial construction growth expect modest 6 percent growth to continue in 2015 followed by a 5 percent growth in 2016.

Finally, FMI's 2015 overview predicts about half of the U.S. construction regions will meet or exceed its 2014 forecast but will experience reduced projected growth rates in 2015, with the exception of New England and the Pacific regions.

A few additional highlights from the Overview:

- The oil and gas industry in North America is driving growth in the industrial market but could be draining talent and resources from other sectors.

- Finding and retaining effective leaders, craftsmen and workers remains a challenge with the marketplace seeking solutions through increased productivity, improved business practices, aggressive recruiting and succession planning.

- Funding for needed heavy civil projects will continue to be challenging.