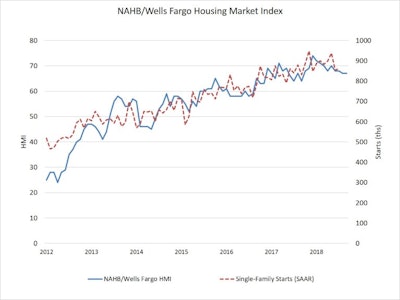

Builder confidence in the market for newly-built single-family homes remained unchanged at a solid 67 reading in September on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

Despite rising affordability concerns, builders continue to report firm demand for housing, especially as millennials and other newcomers enter the market. The recent decline in lumber prices from record-high levels earlier this summer is also welcome relief, although builders still need to manage construction costs to keep homes competitively priced. Wages and subcontractor payments continue to rise as the labor market for residential construction sector remains tight.

National Association of Home Builders

National Association of Home Builders

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index measuring current sales conditions rose one point to 74 and the component gauging expectations in the next six months increased two points to 74. Meanwhile, the metric charting buyer traffic held steady at 49. Looking at the three-month moving averages for regional HMI scores, the Northeast rose one point to 54 and the South remained unchanged at 70. The West edged down a single point to 73 and the Midwest fell three points to 59.