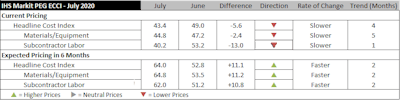

Engineering and Construction costs fell in July, according to IHS Markit and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 43.4 in July, falling from an almost neutral mark in June. The materials and equipment portion of the index came in at 44.8, still indicating falling prices, while the subcontractor portion came in at 40.2, reversing from rising costs last month.

Labor prices moved back into negative territory after briefly jumping above the neutral mark of 50 in June, with the sub-index for current subcontractor labor registering 40.2 in July. Labor costs fell in every region of the United States and Canada.

“Demand for construction workers rebounded swiftly in May and June as contractors resumed work on projects which had broken ground prior to the outbreak of COVID-19,” said Emily Crowley, associate director, IHS Markit. “However, new investments are being delayed. As projects are completed workers are being laid off instead of being moved to a new work site, resulting in weaker demand for workers and lower wages.”

The materials and equipment sub-index recorded the fifth consecutive month of falling prices. Survey respondents reported falling prices for eight out of the 12 components. Ocean freight (from Asia to The U.S. and Europe to The U.S.) increased after staying flat the previous two months. Ready-mix concrete prices continued to increase; this is the only commodity that is not registering the downward price pressures of COVID-19, as prices have increased every month of 2020, with the exception of April when prices stayed flat. Copper-based wire and cable prices increased in July after staying flat in June, recording the first time wire and cable prices rose since February.

“Copper prices have rallied strongly over the past three months on a combination of optimism over Chinese consumption and continuing supply-side disruptions,” said John Mothersole, director, IHS Markit “We have two cautions going forward, however. First, we still see global consumption falling by more than five percent in 2020. Second, disruptions to mine production will be temporary. Production will likely rise to normal levels in the third quarter or in the fourth quarter. Any disappointment over consumption coupled with revived production exposes the market to a correction given the recent run-up in prices.”

“Despite current pricing conditions, respondents indicated expectations of rising prices in the future, as the sector, and the economy as a whole, recovers from the COVID-19 induced shock,” said Deni Koenhemsi, principal economist, IHS Markit.

The six-month headline expectations for future construction costs index rose in July with an index figure of 64.0, up from last month’s 52.8. Both the materials/equipment and labor subcomponents indexes recorded expectations of future price increases. The six-month materials and equipment expectations index came in at 64.8 this month, up from 53.5 last month, with responders expecting increasing prices for all categories with the exception for heat exchangers. Expectations for subcontractor labor registered 62.0 in July; labor costs are expected to rise in all regions of the United States and Canada.

In the survey comments, respondents continued to note lower demand conditions due to the novel coronavirus (COVID-19) and no shortages for most categories.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.