Continuing September’s positive upward trend, total construction starts rose 16% in October, surpassing the $1 trillion mark in terms of overall value for the first time in 2021. Propelled by three large projects, total starts reached a seasonally adjusted annual rate of $1.01 trillion for the month, Dodge Construction Network reports.

“Economic growth has resumed following the third quarter’s Delta-led slowdown. However, the construction sector’s grip on growth remains tenuous,” cautioned Richard Branch, Dodge Construction Network's chief economist. If it had not been for three large projects breaking ground in October – two massive manufacturing plants and an LNG export facility – total construction starts would have actually fallen 6% for the month.

“Long term, construction starts should improve, fed by an increase of nonresidential building projects in the planning pipeline and the recent passage of the infrastructure bill. Both will provide meaningful support and growth to construction in the year to come,” Branch comments. “This expectation, however, must be tempered by the significant challenges facing the industry: high prices, shortages of key materials and the continued scarcity of skilled labor. While healing from the pandemic continues, there’s still a long road back to full recovery.”

By industry segment, nonresidential building starts rose 29% and nonbuilding moved 52% higher in October, with residential starts losing most of the momentum of the previous month. Regionally, total construction starts improved in the South Central and West regions, while slipping in the Northeast, Midwest and South Atlantic regions.

Residential Building

Residential building starts fell 8% in October to a seasonally adjusted annual rate of $388.6 billion, largely negating September's 9% gain. Single-family starts rose less than 1%, while multifamily starts fell 24%.

The largest multifamily structures to break ground in October were:

- the $286 million first phase of the Archer Towers in Jamacia, NY,

- the $120 million residential portion of a mixed-use building on 3rd Ave in Bronx, NY,

- and the $106 million Su Development Yesler Terrace Housing Block in Seattle, WA.

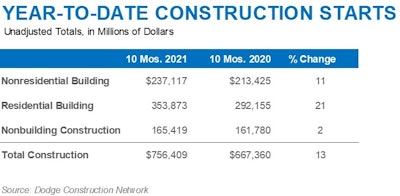

Despite recurring setbacks during the year, residential building continues to hold onto its post-pandemic recovery, rising 21% during the first 10 months of 2021 vs. the same period in 2020. Single-family starts are up 22% and multifamily starts grew 10%.

For the 12 months ending in October 2021, total residential starts were 20% higher than the 12 months ending in October 2020. Single-family starts rose 23% and multifamily starts were 11% higher.

Nonbuilding Construction

Nonbuilding construction starts saw substantial increases in October, skyrocketing 52% to a seasonally adjusted annual rate of $268.4 billion. However, according to Dodge Construction Network, this increase was almost solely due to the start of the $8.5 billion Venture Global LNG export facility in Plaquemines Parisha, LA, which substantially lifted the utility/gas plant category. Yet, even without this project, the category would have seen a strong gain over the very low level of activity reported in September.

Conversely, the public works side suffered declines for the month, led by a substantial decline in miscellaneous nonbuilding starts (-43%). Highway/bridge and environmental public works also fell 14% and 16%, respectively.

Two other large nonbuilding projects to break ground in October were the $484 million Moses-Adirondack SMART PATH 1&2 Lines rebuild project in the Lewis and St. Lawrence counties of New York; and the $454 million RiverRenew tunnel in Alexandria, VA.

Year-to-date, total nonbuilding starts are up 2% through October.

- Environmental public works rose 23%.

- Utility/gas plant starts are up 14%.

- Highway and bridge starts were 7% lower.

- Miscellaneous nonbuilding fell 13%.

- Utility/gas plant starts fell 10%.

For the 12 months ending in October 2021, total nonbuilding starts slid 1% compared to the same period last year.

- Environmental public works starts were up 22%.

- Highway and bridge starts were down 7%.

- Utility and gas plant starts dipped 10%

- Miscellaneous nonbuilding starts fell 7%.

Nonresidential Building

Nonresidential building starts climbed a respectable 29% higher in October to a seasonally adjusted annual rate of $357.2 billion, primarily on gains in manufacturing due to two sizable projects breaking ground. Total nonresidential building starts would have fallen 3% without these projects kicking off.

Commercial starts lost 4% in October, with only hotels posting a gain. Institutional starts gained 4%, with all categories showing increases.

The largest nonresidential building projects to break ground for the month were:

- the $6.0 billion first phase of the Taiwan Semiconductor plant in Phoenix, AZ,

- the $1.3 billion Methanex Methanol plant in Geismar, LA,

- and the $550 million second phase of the Loews Hotel and Convention Center in Arlington, TX.

In the first 10 months of 2021, nonresidential building starts rose 11%.

- Commercial starts were up 9%.

- Manufacturing starts jumped a whopping 94% (39% without the large projects this month).

- Institutional starts were up 3%.

For the 12 months ending in October 2021, nonresidential building starts were up 4% vs. the same period last year. Both commercial and institutional starts were up 2%, and manufacturing starts rose 24% for the period.

Information provided by Dodge Data & Analytics and edited by Becky Schultz.