Construction software companies ranging from Procore to Flashtract have embedded third party finance technology from partners in their products to help their customers get paid faster, finance projects for customers and secure insurance. New York City-based Constrafor takes this concept of embedded in-app purchases to the next level, and has just nailed down nine figures in seed funding for its software that is built around its own fintech and finance offering.

Constrafor’s multi-tenant software-as-a-service (SaaS) application touches on a number of accounting and management disciplines, extending its core offering of gap financing. In June of 2022, the company announced a $100 million seed round in debt and equity primarily according to sources to fund loans for its Early Pay Program (EPP). The credit portion of the funding came from CoVenture, which augments an equity round led by Fintech Collective with Village Global, Clocktower Technology Ventures, Commerce Venture and tech founders from Ramp, Uber, and Paxos.

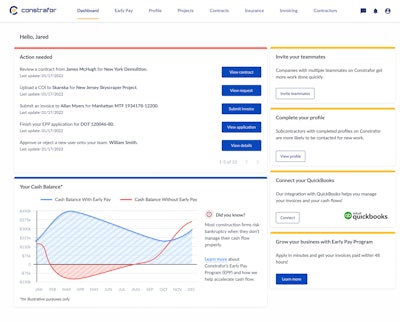

Constrafor’s platform helps general contractors and subcontractors collaborate through streamlined documentation and information exchange, all built around the EPP that accelerates subcontractor cash flows. Through EPP, subcontractors can get paid for their approved invoices within 24 to 48 hours, improving cash flows by up to 80 days without having to use lending sources disconnected from their software workflow.

For general contractors, Constrafor’s robust cloud platform streamlines and expedites subcontractor procurement, administration, including contracts, certificates of insurance (CoI), invoices, payments and diversity procurements. For subcontractors, the platform offers the EPP and accounts payables functionality. These tools can be integrated with enterprise resource planning (ERP) software and other applications that contain relevant data.

New Entry Into a Crowded Market

Various levels of finance, procurement, contract and subcontract automation are already features of products in the market, ranging from Kojo for procurement, Billy for CoI, AvidXchange for accounts payable, and others. Then there are numerous ERP products and project management softwares like Procore that embed lending through partners and automate administrative tasks and often embed external construction finance offerings. Due to the rapidly evolving nature of construction technology, large gaps between even between apparently similar offerings exist—Kojo for instance automates procurement for materials, whereas Constrafor focuses on the subcontract. In time, solutions could consolidate or evolve to the point that they can encompass all sources of project cost, including subcontracts, materials, equipment rental and even capital expenditures.

In a June debriefing session, Constrafor Founder Anwar Ghauche said that while in some parts of a contractor’s business his company has a unique product, in other areas, functionality has evolved to become somewhat commoditized and they Constrafor has to make a concerted effort to perform better than competitors. Ghauche said that for CoI for instance, Constrafor is every bit as sophisticated as Billy, a best-of-breed artificial intelligence (AI) tool that uses optical character recognition (OCR) and machine learning to capture and track not only indemnification levels for each certificate but also riders, which combined are too complex for a human to keep track of.

“This is fairly standard in the industry,” Ghauche said. “We actually go a step further—we look at who is the carrier offering the coverage to the subcontractor, and ratings of the carrier. It is up to our customer what carriers they want to work with—if they are okay with a carrier that is rated at a B minus, that is up to them. They might be okay with a B minus carrier providing auto, but not for a carrier for general liability.”

Ghauche said that automating CoI was relatively simple given that the documents are fairly standard—while a lack of standardization meant automating accounts receivables was more complex.

“Invoicing is a lot more complex—invoices come in a lot of shapes and forms,” Ghauche said.

But what brings value to Constrafor’s accounts receivable and other functionality is that it is part of a broader quote to cash lifecycle facilitated by the software.

“You can think first about the prequalification side,” Ghauche said. “When a general contractor is prequalifying subcontractors. That is step one. Step two is the bidding element—collecting bids of and selecting subcontractors. Step three is the contract, where the general contractor is doing the back and forth on the contract documents with subcontractors. Step four is the CoI. Step five is invoicing. Step six is payment. Step seven is optional—diversity tracking. The final step is closeout, when the general closes out the packages with subcontractors.”

Constrafor then connects the accounts payable function of the general contractor to the accounts receivable side of the subcontractors. Constrafor functionality does not address accounts payable for generals, which would involve application for payment and invoicing processes with project owners.

All of this functionality can notch out native functionality in either a financials software product or in project management or construction ERP software that encompasses the quote-to-cash continuum. This will be particularly attractive for historically on-premise construction software because contractors can keep this mature and functionally deep technology with more cloud-enabled tools, getting the best of both worlds.

Constrafor has standard integrations with major construction ERP and accounting packages, and Ghauche said the company would soon publish a list of these including, Procore, Quickbooks, CMIC, Sage 300 and more. Most integrations are built by Constrafor directly, but more complex ones with on-premise software have involved integration platform-as-a-service providers like Ryvit or HH2.

Role Reversal on Construction Fintech

But the headline news with Constrafor is its financial service-centric business model. Embedded financing is popping up in multiple construction products, usually through partnerships with fintechs, some of which are specific to construction. With this seed round, Constrafor, however, is self-funding the loans.

“Our whole point—and the reason we did such a big raise—is that we need the cash for the Early Pay Program,” Ghauche said, stressing that a lot of work had already been done. “We have the application. We have a proper credit team, a proper treasury team, a proper underwriting team. That is why it is an unusually large seed round—we need that cash.”

This requirement for cash for what amounts to a bank for contractors means that even though Constrafor has just completed a seed round, minimum viable product is largely done and released to market. According to Ghauche, close to 400 general contractors are currently paying customers, and the number of subcontractor users is well into five digits. Subcontractors can use the software for free unless they take advantage of the EPP, and according to Ghauche, the program is compelling enough that about half have opted into the paid version.

EPP lending decisions are reinforced by data insights from within the Constrafor software product, and according to Ghauche, the software and the underlying relationship is deeper than can be the case when a software company partners with a fintech outfit to deliver embedded financing.

“We know our customers intimately well,” Ghauche said. “We are very much involved in their day to day, which you cannot do with a company like Procore which a much larger organization with more customers. With Early Pay—we are going into the detail of the bid. A subcontractor will reach out to us and say ‘we are bidding on this project can you support me there?’ We have a very tight relationship with our customers which Procore cannot deliver given the third party providers they are synching up with,” Ghauche said. “That being said we do synch up with Procore, and are one of the third party providers they offer up to their customers.”

Constrafor does however also complete with Procore and many other project management and construction business applications with its CoI and invoicing functionality, counting on the EPP and deeper, more robust functionality to get Procore users to notch out those portions of the solution in favor of Constrafor.

Constrafor Tech Stack

Constrafor is a multi-tenant software-as-a-service (SaaS) application provisioned in the Amazon Web Services cloud. The application fails over to multiple different availability zones in the United States. Databases include Postgres and database back ends resident in the Django Python web framework. The presentation layer seen by end users comes courtesy of Angular and Java script. New product is shipped daily, which suggests security and bug fixes are in place in a timely fashion, enhancing application and data security.

Constrafor also leverages functionality through an application programming interface (API) from Stripe to handle payments.

A Fit for Complexity

Constrafor serves both general contractors and subcontractors and can meet the needs of a broad addressable market of each. Ghauche said the software will be a potential fit for general contractors working on commercial and industrial, multi family and infrastructure projects. Those general contractors with large numbers of subcontractors will find the product more appealing than those with fewer. And general contractors engaged in projects with a Minority and Women-Owned Business Enterprise (MWBE) requirement may find a fit as well due to Constrafor’s ability to pull subcontractor diversity certifications from subcontract qualification, data on MWBE contractor commitments from the contract data and MWBE spend figures from invoicing.

Currently, Constrafor addresses only entity-level tracking of MWBE contracts, and does not capture or present information on the workforces those certified contractors send to the job. In some audited environments, it can be important to prove to regulators, project owners or even a judge that contract was not a pass-through. Contractors need to prove their people were not in fact the ones performing work on behalf of the subcontractor. Ghauche said Constrafor was, however, looking forward to expanding into workforce reporting, either by developing their own functionality or through a partnership.

BOTTOM LINE: Constrafor has an interesting footprint of functionality, solving some challenging cash flow problems for subcontractors and streamlining operations across a broad swath of backend processes for both generals and subs. They seem intent on growing the software’s functional breadth and depth. But what is truly remarkable about Constrafor is the fact that they are a financial services company at their core, and are building up a construction business software platform around this service. It is a potentially transformative way to deliver both software and financial services, compared to more established construction software vendors that find a friend to deliver in-app purchases of everything from loans to legal assistance to materials. Those evaluating Constrafor should probably ask for details on future roadmap items—Ghauche implied the seed cash would go mostly to fund the Early Pay Program, so a buyer may want to get visibility into what they are investing in product and perhaps, given the fact that Constrafor is an early stage company, influence the product direction to help them solve problems in new ways.