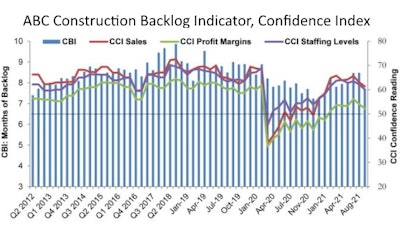

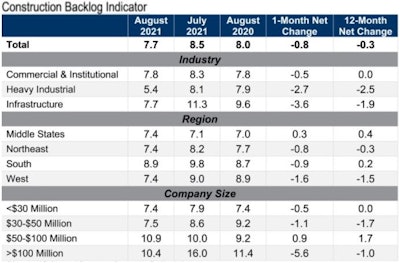

A main indicator of nonresidential contractors’ backlogs of work suffered a steep drop in August after slipping in each of the two previous two months. All of the accompanying Associated Builders and Contractors’ Construction Confidence Index readings lost ground, after many months of continuing to rise despite spending slippage.

Click on this table to see a larger view.Associated Builders and Contractors

Click on this table to see a larger view.Associated Builders and Contractors

Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August but remain above the threshold of 50, indicating expectations of growth over the next six months.

“Both contractor backlog and confidence have begun to fade,” said ABC Chief Economist Anirban Basu. “Higher materials prices and labor costs have conspired to put more projects on hold. In many instances, expanding costs have rendered projects infeasible.

Click on this table to see a larger view.Associated Builders and Contractors

Click on this table to see a larger view.Associated Builders and Contractors

The dampened outlook among ABC’s nonresidential-construction membership is not unexpected. Nonresidential spending year-to-date has fallen 7.5% compared to the first seven months of 2020, with persistent declines in recent months. One contributor to this trough could be nonresidential construction’s typical position as a lagging indicator to recessions. Big nonres projects already underway tend to carry momentum through the broader economy’s downturn, but planning falters. Actual construction work slows after the rest of the economy is recovering.

But Basu says a unique crimp in the construction-spending pipeline is lack of capacity. Many contractors report turning work down for lack of labor, and soaring materials prices have put some projects on hold. The end of temporary unemployment benefits could reduce labor difficulties quickly, and corrections in materials costs like lumber’s in June could open the flood gates on the flow of nonresidential investment.

“With so much liquidity continuing to be injected into financial systems, investors have considerable sums to deploy in new investments,” said Basu. “Real estate valuations and construction volumes benefit from such dynamics. Recent dips in commodity prices and more normal labor market functioning should help translate into slower cost escalations and rebounding backlog during the months ahead, ultimately reversing the backlog decline sustained in August.”