The U.S. Chamber of Commerce has released new guides for businesses of all sizes to secure relief under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

“The U.S. Chamber of Commerce is working with state and local chambers across the country to provide businesses with the information they need to stay afloat and keep people employed during the pandemic,” said Suzanne Clark, President of the U.S. Chamber of Commerce. “These comprehensive guides ensure business owners fully understand what aid is available to them and how to access those funds as quickly as possible. We are committed to ensuring no family or business goes bankrupt due to financial hardships associated with the coronavirus.”

NEW: Economic Injury Disaster Loan Guide

The CARES Act expanded the Small Business Administration’s long-standing Economic Injury Disaster Loan Program(EIDL), which includes $10,000 grants for eligible applicants. The EIDL program was created to assist businesses, renters, and homeowners located in regions affected by declared disasters.

The guide is available at:uschamber.com/eidl

NEW: Employee Retention Tax Credit Guide

The CARES Act created a new employee retention tax credit for employers who are closed, partially closed, or experiencing significant revenue losses as a result of the coronavirus.

The guide is available at: uschamber.com/ertc

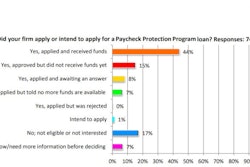

UPDATED: Small Business Emergency Loan Guide

The U.S. Chamber’s Coronavirus Small Business Emergency Loan Guide, first issued last week, outlines the steps small businesses need to take to access much-needed Payroll Protection Program(PPP) funds. The guide now includes important information including key dates as the government moves toward implementation. Recently, the Treasury Department issued more details on this paycheck protection program and a loan application available for download.

Starting April 3, small businesses and sole proprietorships can apply for loans. Starting April 10, independent contractors and self-employed individuals can apply for loans.There is a funding cap, so the Treasury Department recommends applying as soon as possible.

The guide is available at:uschamber.com/sbloans. A Spanish language version of the guide is at:uschamber.com/sbloansESP

The U.S. Chamber of Commerce is committed to helping American businesses respond to the coronavirus so they can support their employees, customers, and communities. Our members and the state and local chambers, who are on the front lines of this pandemic, need us now more than ever to help them through this significant disruption. We will continue working every day to help our country’s people, businesses, and economy weather this storm and emerge stronger—just as we have at other challenging times in our nation’s history. Visit uschamber.com/coronavirus for more information.