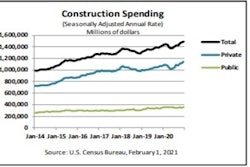

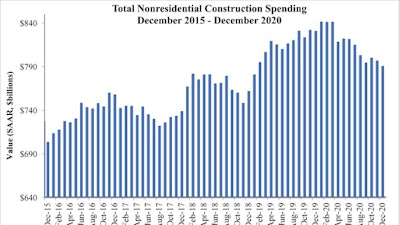

National nonresidential construction spending declined 0.8% in December 2020, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $790.2 billion for the month, 4.8% lower than in December 2019 but 3.8% higher than in December 2018.

Spending fell on a monthly basis in nine of the 16 nonresidential subcategories. Private nonresidential spending was down 1.7%, while public nonresidential construction spending was up 0.5% in December.

“The slump in nonresidential construction spending has now persisted for several months,” said ABC Chief Economist Anirban Basu. “Leading indicators are not promising, including ABC’s Construction Backlog Indicator, which remains 1.5 months lower than in December 2019. The pandemic has ravaged commercial real estate fundamentals, and this sector will likely remain weak for years to come due to behavioral shifts caused by the COVID-19 pandemic. That weakness will limit the initial pace of private construction spending recovery in a number of key segments, even as the pandemic fades in the rearview mirror.

“Given weakened state and local government finances, public construction’s trajectory is not especially promising either,” said Basu. “Near-term spending growth is partially a reflection of what had been a strong economy pre-pandemic and the improvement in public finances that accompanied the lengthiest economic expansion in America’s history. Backlog was plentiful coming into the crisis, and that continues to be reflected in public spending data. Emergency construction spending has also boosted spending as decision-makers look to expand the capacity of healthcare delivery in the near-term.

“While it is true that the broader economy is poised for rapid economic recovery later this year, nonresidential construction is positioned to lag,” said Basu. “This is often the case given the tighter lending standards and the higher commercial vacancy rates that accompany periods of economic stress. However, the lag in industry recovery could be even lengthier this time around as the specter of remote work threatens the office market, online meeting platforms interfere with recovery in business travel, and more people shop from home as opposed to on Main Street and in malls. The implication is that absent a meaningful federal stimulus package, many nonresidential construction firms and their workers will face a period of vulnerability.”