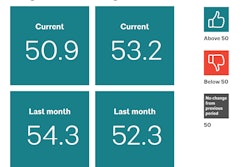

Construction costs rose for the seventh consecutive month in May, according to IHS Markit (Nasdaq: INFO) and the Procurement Executives Group (PEG). The headline IHS Markit PEG Engineering and Construction Cost Index registered 54.0 in May, down from 57.0 in April. Both the materials/equipment and labor categories showed increases, though compared to April, the cost increases were not as broad.

The materials/equipment price index came in at 55.2, almost five points lower than in April, which was one of the highest figures recorded in the survey’s history. Seven of the 12 categories tracked in the materials sub-index showed rising prices; five categories registered flat pricing; and no category in the survey recorded falling prices. While the copper-based wire and cable price index hit the neutral point in May, steel prices remained elevated despite some give back.

“Steel prices peaked in April and are now beginning to weaken. Price drops will continue through at least the third quarter, more likely until the end of the year,” said John Anton, senior principal economist at IHS Markit. “Upside risk comes from the ‘Buy American’ proposal for pipelines, which is causing concern among energy buyers and plate consumers. If the proposal is enacted in its strongest form, there could be shortages in supply and allocation.”

The current subcontractor labor index rose slightly above the neutral mark at 51.3. Regionally, the U.S. Midwest had rising labor costs, while the U.S. Northeast, South, and West showed flat labor market conditions. In Canada, labor costs rose in Eastern regions and fell in Western regions.

The six-month headline expectations index recorded another month of increasing prices. While the index moved down from 69.3 in April to 60.6 in May, it is still considered a high reading. The materials/equipment index stayed positive at 61.8, lower than the 72.8 recorded from the prior month.

Nine consecutive months of rising prices affirm widespread expectations of future higher costs. Expectations of a future price increase were broad based, with index figures for every component coming in above neutral. However, similar to current prices, cost increases are not expected to be as high as last month’s figures. Subcontractor labor price expectations came in at 57.9 in May, lower than the 60.9 recorded in April. Labor costs are expected to rise in all regions of the United States and Canada.

In the survey comments, some respondents noted diminishing inventories while others noted no shortages. Participants continue to express optimism for 2017, with the proposal activity index looking positive in the last 10 months.

To learn more about the new IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.