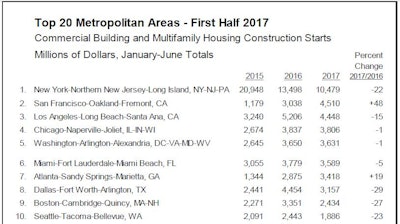

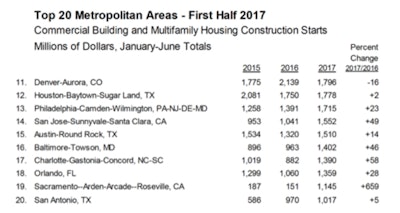

During the first half of 2017, eight of the top 10 metropolitan markets for commercial and multifamily construction starts ranked by dollar volume registered decreased activity compared to a year ago, according to Dodge Data & Analytics. At the same time, metropolitan markets ranked 11 through 20 showed growth for nine of the 10 markets, as smaller geographic areas are picking up the slack from the deceleration underway in those cities that have led the commercial and multifamily upturn over the past several years.

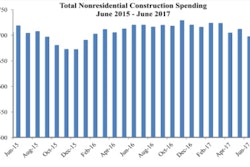

At the national level, the volume of commercial and multifamily construction starts during the first half of 2017 was $87.5 billion, down 9% from last year’s first half, although still a slight 1% above what was reported during the first half of 2015.

The New York NY metropolitan area, at $10.5 billion in the first half of 2017, maintained its No. 1 ranking and comprised 12% of the U.S. commercial and multifamily total, but was down 22% from a year ago. The New York NY metropolitan area reached a peak back in 2015, when $35.3 billion in commercial and multifamily construction starts were reported for the full year, comprising 17% of the national total. In 2016, the area dropped 16% for the full year, and now is on track for another decline in 2017.

Other metropolitan areas in the top 10 with double-digit declines in the first half of 2017 were Los Angeles CA ($4.4 billion), down 15%; Dallas-Ft. Worth TX ($3.2 billion), down 29%; Boston MA ($2.4 billion), down 27%; and Seattle WA ($1.9 billion), down 23%. Miami FL ($3.6 billion) dropped a moderate 5% during the first half of 2017, and the two markets in the top ten with only slight declines were Chicago IL ($3.8 billion) and Washington DC ($3.6 billion), each down 1%.

The two metropolitan areas in the top ten that showed growth during the first half of 2017 were San Francisco CA ($4.5 billion), up 48%; and Atlanta GA ($3.4 billion), up 19%. San Francisco was lifted by the start of the $1.3 billion Oceanwide Center Tower, while Atlanta benefited from the start of the $240 million Coda Building in Georgia Tech’s Technology Square.

For those markets ranked 11 through 20 in the first half of 2017, the only decline was reported for Denver CO ($1.8 billion), down 16% from a year ago. The remaining nine markets, listed in order by the volume of activity, were the following: Houston TX ($1.8 billion), up 2%; Philadelphia PA ($1.7 billion), up 23%; San Jose CA ($1.6 billion), up 49%; Austin TX ($1.5 billion), up 14%; Baltimore MD ($1.4 billion), up 46%; Charlotte NC ($1.4 billion), up 58%; Orlando FL ($1.4 billion), up 28%; Sacramento CA ($1.1 billion), up 659%; and San Antonio TX ($1.0 billion), up 5%. The huge percentage increase for Sacramento CA reflected the start of the $600 million McClellan Business Park Data Center, as well as the comparison to a particularly low amount during the first half of 2016 (when Sacramento ranked 81 of metropolitan areas by dollar volume instead of this year’s first half ranking at 19).

The commercial and multifamily total is comprised of office buildings, stores, hotels, warehouses, commercial garages, and multifamily housing. At the U.S. level, the 9% decline for the commercial and multifamily total during the first half of 2017 was due entirely to a slower pace for multifamily housing, which dropped 18%, while commercial building held steady with its first half 2016 amount.

“Multifamily housing served as the leading edge of the current construction expansion, and increasingly it looks like it reached its peak in 2016,” stated Robert A. Murray, chief economist for Dodge Data & Analytics.

Much of the early multifamily growth reflected an exceptional amount of activity taking place in the New York NY metropolitan area, boosted by developers trying to get projects started prior to the expiration of the 421-a program in early 2016, as well as the lift coming from foreign investment. Multifamily housing for the area fell 29% for the full year 2016, and during the first half of 2017 it was down 23% from a year ago.

In addition, several other markets contributed to this year’s multifamily retreat, with these declines compared to especially elevated amounts during the first half of 2016 – Dallas-Ft. Worth TX, down 57%; Boston MA, down 51%; Miami FL, down 43%; Seattle WA, down 32%; and Chicago IL, down 6%. Even so, this year’s first half has seen multifamily housing advance in such markets as San Francisco CA, up 17%; Washington DC, up 13%, Atlanta GA, up 7%; while Los Angeles CA matched its improved 2016 amount.

Murray indicated, “Although it’s true that lenders are exercising greater caution toward multifamily projects, more construction is taking place in those markets which have been relative latecomers to the expansion, and this is helping to limit the extent of the multifamily slowdown now underway at the national level.”

With regard to the steady performance by commercial building for the U.S. during the first half of 2017, this reflects gains for office buildings and warehouses, which have balanced weaker activity for stores, hotels, and commercial garages. Murray added, “Office buildings and warehouses continue to see low vacancy rates, and both project types are expected to show growth in construction starts when the full year 2017 figures are tallied. However, hotel construction starts appear to have reached a peak in 2016, which included groundbreaking for several large hotel and casino projects, while store construction has remained weak.”

By geography, the top 10 commercial and multifamily markets in the first half of 2017 were evenly split between those showing gains for commercial building and those showing declines. Increases were reported in this year’s first half for San Francisco, up 83%; Miami FL, up 64%; Atlanta GA, up 30%; Chicago IL and Boston MA, each up 5%. Reduced activity compared to the first half of 2016 was reported for Dallas-Ft. Worth TX, down 10%; Washington DC, down 11%; Seattle WA, down 14%; New York NY, down 21%; and Los Angeles CA, down 32%.

Results by Metro Area

Although the New York NY metropolitan area witnessed a 22% decline for commercial and multifamily construction starts in the first half of 2017, it was relative to a strong first half of 2016, which itself was down from the robust activity reported in 2015’s first half. To add some perspective to the first half 2017 activity, the $10.5 billion in construction starts was slightly higher than the $10.2 billion that was reported during the first half of 2014, prior to the exceptional amounts in 2015 and 2016.

Multifamily housing, while sliding 23% in this year’s first half, still included the start of 12 projects valued at $100 million or more, led by the $450 million Wall Street Tower mixed-use building in lower Manhattan and the $423 million City Point apartment building in Brooklyn NY. Within the 21% decline for commercial building was a more moderate 8% drop for office building, which featured the first half 2017 start of such projects as a $355 million office/retail mixed-use building in Brooklyn NY and the $300 million LG corporate headquarters building in Englewood Cliffs NJ.

The 48% jump for the San Francisco CA metropolitan area during the first half of 2017 was led by an 83% surge for its commercial building sector. The $1.3 billion Oceanwide Center Tower in San Francisco included $913 million for commercial projects (office, hotel, garage), plus there were several other noteworthy projects that reached groundbreaking. These included the $361 million office portion of the $1.0 billion Golden State Warriors Arena (Chase Center) complex in San Francisco, the $310 million Facebook office building in Menlo Park, and the $232 million City Center office building in Oakland.

Multifamily housing, up 17%, included four projects valued at $100 million or more, led by the $387 million multifamily portion of the Oceanwide Center Tower and the $177 million Transbay Block 1 in San Francisco.

The Los Angeles CA metropolitan area, with a first half 2017 decline of 15% for its commercial and multifamily total, reflected a 32% slide by its commercial segment while multifamily housing maintained the heightened level reported during the first half of 2016 (which was up 59% from the first half of 2015). Last year saw the start of the $500 million renovation of the Beverly Center in Los Angeles and the $178 million Broadcom Research and Development Campus in Irvine, while so far this year there was just one commercial project above the $100 million mark, that being the $106 million hotel portion of the $500 million One Beverly Hills mixed-use complex in Beverly Hills.

Multifamily housing during the first half of 2017 featured 7 projects valued at $100 million or more, led by the $364 million Jefferson Stadium Park apartments in Anaheim and the $349 million multifamily portion of the One Beverly Hills complex.

The Chicago IL metropolitan area slipped 1% in the first half of 2017, with commercial building up 5% while multifamily housing retreated 6% compared to last year. On the commercial side, the lift came from the $500 million renovation/addition to the Willis Tower in Chicago and a $211 million data center in Wood Dale IL.

Although multifamily housing was down from a year ago, which included the $500 million One Bennett Park Tower in Chicago, the first half of 2017 featured the start of several large projects, all located in Chicago – the $650 million One Grant Park (phase 1), the $280 million One South Halstead apartment tower, and the $240 million Essex Inn & Essex on the Park apartment tower.

Easing back 1%, the Washington DC metropolitan area showed growth for multifamily housing, up 13%; while the commercial building sector dropped 11% in the first half of 2017. There were two mixed-use developments that reached groundbreaking so far during 2017, whose multifamily portions were valued at $188 million and $126 million respectively. The commercial building sector included a $395 million data center in Sterling VA plus two office renovation projects in Washington DC – the $114 million Anthem Row office complex and the $100 million Cannon House office building (phase 1).

The Miami FL metropolitan area, dropping 5% during the first half of 2017, showed a sharply different performance by its multifamily and commercial sectors, with multifamily housing down 43% while commercial building jumped 64%. Multifamily housing in this market reached a peak in 2016 at $5.3 billion (up 21%) for the full year, boosted by such projects as the $315 million Armani/Casa Condominiums in Sunny Isles Beach. The first half of 2017 has also seen the groundbreaking for several large multifamily projects, such as the $190 million Koi Residences and Community Center in Pompano Beach and the $175 million Midtown 8 apartments in Miami, but overall the volume of multifamily construction starts is trending downward.

The commercial sector during the first half of 2017 was boosted by $744 million for the commercial portion (hotel, retail, garage) of the $900 million expansion to the Seminole Hard Rock Hotel and Casino in Hollywood FL.

Rising 19% during the first half of 2017, the Atlanta GA metropolitan showed widespread growth compared to last year, with its commercial segment up 30% while multifamily housing increased 7%. The commercial segment included groundbreaking for three large projects – the $240 million Coda Building, the $190 million Kroger store and office building, and a $120 million logistics center for United Parcel Service. Multifamily housing included three projects valued at $100 million or more – the $145 million 1000 Park Avenue apartment tower, the $142 million Hanover Midtown apartments, and the $140 million Icon Buckhead apartments.

The improved levels for commercial and multifamily construction starts finally took hold in the Atlanta GA metropolitan area during 2014, with a 42% increase that year, followed by gains in 2015, up 17%; and 2016, up 54%. The current year is on track for further improvement.

The Dallas-Ft. Worth TX metropolitan area retreated 29% during the first half of 2017, following a very strong first half of 2016, up 82% (and 58% for the full year 2016) that included $500 million for a segment of the Toyota Corporate Campus development in Plano and the $130 million Park District apartments in Dallas.

During the first half of 2017, commercial building was down 10% from its corresponding 2016 amount, although the current year did see groundbreaking for two projects in Fort Worth, a $300 million Facebook data center and the $300 million American Airlines Trinity Campus. Multifamily housing during the first half of 2017 experienced a more severe decline, falling 57%, despite the start of several large projects such as the $120 million Residences at Legacy apartment building in Plano. Multifamily housing had shown very strong growth from 2011 through 2016, including annual gains of 45% in 2015 and 27% in 2016, but now appears to be settling back.

The Boston MA metropolitan area, down 27% in the first half of 2017, retreated from an elevated first half of 2016, up 48% (and 54% for the full year 2016), that included such projects as the $162 million Harrison St. apartments and the $150 million Pier 4 office building (phase 2). Multifamily housing fell sharply during the first half of 2017, sliding 51%, despite the start of several large projects including the $200 million Residences at 399 Congress St. Commercial building, in contrast, increased 5% compared to a year ago, with the lift coming from such projects as the $200 million 145 Broadway Commercial Building A in Cambridge and the $166 million General Electric Global Headquarters in Boston.

The Seattle WA metropolitan area retreated 23% during the first half of 2017, following the steady commercial and multifamily growth reported during the 2011-2016 period, including a 23% increase for full year 2016. The multifamily segment dropped 32% during this year’s first half, as groundbreaking for the $152 million Nexus multifamily tower was not able to offset a more broad-based pullback for multifamily housing. Commercial building in the first half of 2017 was down 14% from a year ago, although this year did include the start of a $228 million office high-rise in Seattle and an $80 million warehouse in Tacoma.