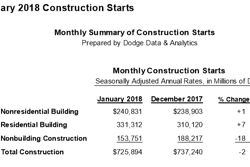

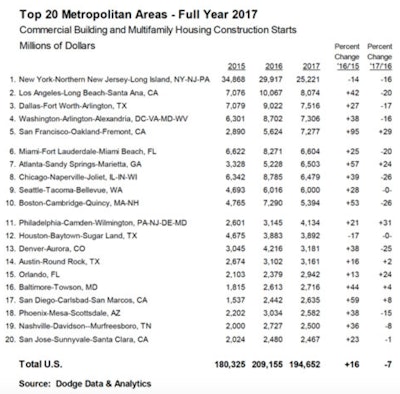

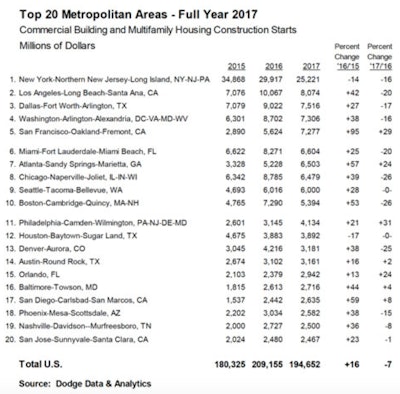

Many of the leading U.S. metropolitan areas for commercial and multifamily construction starts showed reduced activity in 2017 compared to levels reported during 2016, according to Dodge Data & Analytics. Of the top 10 markets ranked by the dollar amount of construction starts, seven registered declines, one was essentially unchanged, and just two showed greater activity in 2017. For the metropolitan areas ranked 11 through 20, the 2017 performance was more evenly balanced, with four reporting declines, one essentially unchanged, and five reporting gains. At the national level, the volume of commercial and multifamily construction starts was $194.7 billion, down 7% from 2016, although still 8% above the amount reported for 2015.

The New York metropolitan area, at $25.2 billion in 2017, continued to be the leading market in the U.S. for commercial and multifamily construction starts, although it dropped 16% from its 2016 amount. New York’s share of the U.S. total was 13% in 2017, down from 14% in 2016 and 19% in 2015. After reaching its most recent peak back in 2015 at an exceptional $34.9 billion, New York has seen its commercial and multifamily dollar amount slide by 28%. The other six metropolitan areas in the 2017 top 10 with declines from their 2016 amounts were:

- Los Angeles ($8.1 billion), down 20%

- Dallas-Ft. Worth, Texas ($7.5 billion), down 17%

- Washington, D.C. ($7.3 billion), down 16%

- Miami ($6.6 billion), down 20%

- Chicago ($6.5 billion), down 26%

- Boston ($5.4 billion), down 26%

Each of these six metropolitan areas had registered double-digit gains of at least 25% during 2016, and while each retreated during 2017 five were able to stay above their respective 2015 amounts (the exception being Miami). Holding steady in 2017 was Seattle ($6.0 billion), while 2017 gains were reported for San Francisco ($7.3 billion), up 29%; and Atlanta ($6.5 billion), up 24%. The San Francisco metropolitan area drew support from the $1.3 billion Oceanwide Center Tower, while the Atlanta metropolitan area included such projects as the $440 million State Farm Park Center office building complex (phase 2) and the $240 million Coda office building.

For the metropolitan areas ranked 11 through 20, decreased commercial and multifamily construction starts for 2017 were reported for Denver ($3.2 billion), down 25%; Phoenix ($2.6 billion), down 15%; Nashville ($2.5 billion), down 8%; and San Jose, CA ($2.5 billion), down 1%. Houston ($3.9 billion), held steady with its 2016 amount even with the dislocations caused by Hurricane Harvey. Double-digit growth was reported in 2017 for Philadelphia ($4.1 billion), up 31%; and Orlando, FL ($2.9 billion), up 24%. More modest increases were reported for Austin, Texas ($3.2 billion), up 2%; Baltimore, MD ($2.7 billion), up 4%; and San Diego ($2.6 billion), up 8%.

The commercial and multifamily total is comprised of office buildings, stores, hotels, warehouses, commercial garages, and multifamily housing. The 7% drop for commercial and multifamily construction starts at the U.S. level in 2017 reflected mostly a multifamily pullback. Multifamily construction starts at the U.S. level in 2017 dropped 12% to $84.9 billion, which followed a 10% increase in 2016 ($96.1 billion). Commercial building construction starts in 2017 slipped 3% to $109.8 billion, staying close to the 2016 level ($113.1 billion) achieved with a 22% hike that year.

“Of the commercial and multifamily project types, multifamily housing is the one that appears to have already reached its peak and is now heading downward, as shown by the 12% decline in dollar terms during 2017,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “The expansion for multifamily housing began back in 2010, and in 2015 it benefited from a surge of activity in the New York metropolitan area and then in 2016 it showed broader growth geographically due to strong gains by other major metropolitan areas. That pattern shifted in 2017, as markets such as Los Angeles, Dallas-Ft. Worth and Washington DC retreated from the levels posted during 2016. Multifamily vacancy rates, while still low historically, have been edging up slightly on a year-over-year basis for almost two years. In addition, the banking sector has taken a more cautious stance towards lending for multifamily projects. In the most recent survey of bank lending officers by the Federal Reserve. Sixteen percent of the respondents indicated that they had tightened standards for multifamily loans during the fourth quarter of 2017, compared to just 1% of the respondents that reported tightening for nonresidential building project loans. At the same time, the downturn for multifamily housing at the national level is expected to stay moderate for the near term, as the latecomers to the multifamily expansion, particularly in the smaller markets, continue to see growth.”

By geography, eight of the top 10 commercial and multifamily markets in 2017 registered declines for multifamily housing:

- New York, down 4%

- Los Angeles, down 17%

- Dallas-Ft. Worth, down 26%

- Washington DC, down 23%

- Miami, down 50%

- Chicago, down 24%

- Seattle, down 10%

- Boston, down 29%

The two markets in the top ten showing multifamily gains in 2017 were San Francisco, up 3%; and Atlanta, up 26%.

“The picture for commercial building is mixed, as both office buildings and warehouses seem to still be in the process of reaching a peak,” Murray continued. “Although downtown and suburban office vacancy rates edged up slightly in the fourth quarter of 2017, they remain low by recent standards, and warehouse vacancy rates have not yet begun to rise in a sustained manner. At the same time, the lodging sector is seeing slower growth for revenue per available room compared to a few years ago, and hotel construction starts are easing back, particularly from 2016 which saw several very large hotel and casino projects reach the construction start stage. As for store construction, its 10% retreat in dollar terms at the national level during 2017 is consistent with its weak performance in the overall expansion for commercial building to date.”

By geography, six of the top 10 commercial and multifamily markets in 2017 registered declines for commercial building:

- New York, down 28%

- Los Angeles, down 23%

- Dallas-Ft. Worth, down 12%

- Washington DC, down 8%

- Chicago, down 28%

- Boston, down 22%

The four markets in the top 10 commercial building gains in 2017 were San Francisco, up 57%; Miami, up 40%; Atlanta, up 24%; and Seattle, up 8%.

The New York metropolitan area in 2017 registered a 16% slide for commercial and multifamily construction starts, which followed a 14% drop in 2016. The 2017 dollar amount at $25.2 billion was still 17% above the $21.6 billion reported for 2014. The New York metropolitan area had reached a peak in 2015, reflecting the robust volume of multifamily projects making it to the construction start stage that year, as developers pushed projects forward in anticipation of the expiration of the 421-a program. (In brief, the 421-a program gave developers a 10-year tax exemption for building multifamily housing as long as the project set aside affordable units either within the new development or elsewhere.) Multifamily housing in 2016 plunged 27%, but then showed only a 4% decline in 2017 as activity seemed to be stabilizing as a replacement for the 421-a program went into effect. In 2017, there were 25 multifamily projects that reached groundbreaking valued at $100 million or more, led by two projects in lower Manhattan valued at $450 million and $445 million respectively, and the $410 million Brooklyn Point high-rise in Brooklyn. The commercial building sector experienced a steep 28% decline in 2017, following gains of 96% in 2015 and 5% in 2016. Office construction in 2016 had been lifted by groundbreaking for such projects as the $2.0 billion 3 Hudson Boulevard and the $1.5 billion One Vanderbilt Tower, and with one exception the major office building projects in 2017 were smaller in scale, contributing to a 33% decline for this project type. The largest office building project that reached groundbreaking in 2017 was the $1.7 billion 50 Hudson Yards, followed by a $355 million office building in Brooklyn, the $300 million office portion of the $1.6 billion Farley Train Hall redevelopment in Manhattan, and the $300 million LG corporate headquarters in Englewood Cliffs, NJ.

After climbing 42% in 2016, the Los Angeles market experienced a 20% decline for commercial and multifamily construction starts in 2017. Multifamily housing retreated 17% after a 44% jump in 2016. Even with the 2017 decline, there were 12 multifamily projects valued at $100 million or more that reached groundbreaking in 2017, led by the $364 million Jefferson Stadium Park apartments in Anaheim, the $349 million multifamily portion of the $500 million One Beverly Hills mixed-use project in Beverly Hills, and the $242 million AVA Hollywood project in Los Angeles. Commercial building in 2017 fell 23% after climbing 41% in 2016, lifted that year by such projects as the $500 million Beverly Center renovation in Los Angeles and the $389 million Broadcom research and development campus in Irvine. In 2017, the top commercial projects were the $150 million JW Marriott Hotel in Anaheim, the $110 million Vineyards at Porter Ranch retail center in Los Angeles, the $106 million hotel portion of the One Beverly Hills mixed-use project, the $69 million Arcadia Logistics Center in Arcadia, and the $80 million Ivy Station office building in Culver City.

The Dallas-Ft. Worth market dropped 17% in 2017, following substantial gains for commercial and multifamily construction starts in 2015, up 60%; and 2016, up 27%. Multifamily housing registered a 26% decline in 2017, with two projects valued at $100 million or more that reached groundbreaking, compared to four such projects in 2016. The two largest multifamily projects in 2017 were the $150 million AMLI Fountain Place residential tower in Dallas and the $120 million Residences at Legacy Apartments in Plano. Commercial building in 2017 retreated 12%, including a 21% decline for office buildings that had been supported in 2016 by a $293 million portion of the Toyota Corporate Campus project in Plano. Even with its decline, the office building category in 2017 did include the start of several noteworthy projects, including the $300 million Facebook data center in Ft. Worth, the $300 million American Airlines Trinity Campus in Ft. Worth, the $150 million CyrusOne data center in Allen, and the $138 million renovation of the Dallas County Records Building complex in Dallas. Hotel construction was the one commercial project type that registered a 2017 gain, boosted by the start of the $150 million Live! by Loews Hotel in Arlington and the $115 million Westin hotel at the Irving Convention Center in Irving.

The Washington D.C. metropolitan area posted a 16% decline for commercial and multifamily construction starts in 2017, after rising 38% in 2016. Multifamily housing dropped 23%, following seven straight years of growth. The 2017 dollar amount for multifamily housing was still within 2% of what was reported in 2014. Commercial building in 2017 slipped 8%, due to reduced activity for stores, hotels, and commercial garages. The office category was able to see growth in 2017, climbing 10% with the boost coming from six projects valued at $100 million or more – the $395 million CyrusOne data center in Sterling, VA, the $180 million Sentinel Square office building in Washington D.C., the $165 million Springfield Metro Center II in Springfield VA, the $142 million 700-800 K St. NW/Anthem Row renovation in Washington DC, the $136 million Wheaton Town Center in Wheaton, MD, and the $100 million Cannon House office building renovation in Washington D.C.

The San Francisco metropolitan area advanced 29% in 2017, on top of the 95% jump for commercial and multifamily construction starts that was reported for 2016. Much of the lift in 2017 came from groundbreaking for the $1.3 billion Oceanwide Center Tower, a mixed-use high-rise with this allocation by project type — office at $780 million, multifamily housing at $387 million, hotel at $95 million, and commercial garage at $38 million. With this project, commercial building surged 57% in 2017, including a 132% increase for the office category. The office category was also supported by six other projects valued at $100 million or more, led by the $568 million Stanford University Redwood City office campus in Redwood City, the $361 million office portion of the $1.0 billion Golden State Warriors Arena complex in San Francisco, and the $310 million Facebook office building in Menlo Park. Multifamily housing in 2017 edged up 3%, following the 62% hike that was reported in 2016. Other than the multifamily portion of the Oceanwide Center Tower, there were five multifamily projects valued at $100 million or more that reached groundbreaking in 2017, led by these San Francisco projects — the $224 million multifamily portion of the $380 million Goodwill office/residential development and the $191 million Transbay Block 1 residential complex.

Commercial and multifamily construction starts for the Miami metropolitan area moved in opposite directions during 2017, producing a 20% decline for the commercial and multifamily total after the 25% gain that was reported for 2016. Multifamily housing plunged 50% in 2017, compared to the robust volume in 2016 that included 12 projects valued at $100 million or more, led by the $403 million multifamily portion of the $485 million Brickell Flatiron mixed-use high-rise in Miami and the $315 million Armani/Casa Condominiums in Sunny Isles Beach. For 2017, there were three multifamily projects valued at $100 million or more that reached groundbreaking — the $190 million Koi Residences in Pompano Beach, the $160 million multifamily portion of the $175 million Midtown 8 mixed-use building in Miami, and the $115 million River Landing residential complex in Miami. Commercial building in 2017 soared 40%, due primarily to the boost coming from the $900 million expansion of the Seminole Hard Rock Hotel in Hollywood, FL, with this allocation by project type — hotel at $575 million, stores at $143 million, and commercial garage at $26 million. (The remaining portion at $156 million includes casino and theater space, which is designated by Dodge as amusement-related and falls within the institutional building sector instead of commercial building.) Other projects that contributed to the commercial building increase in 2017 were the $145 million River Landing retail building in Miami and the $109 million Dania Pointe retail and entertainment complex in Dania Beach.

The Atlanta metropolitan area registered a 24% increase for commercial and multifamily construction starts in 2017, which followed a 57% jump in 2016. While Atlanta was a relative latecomer to the commercial building and multifamily expansion, it has now shown steady growth from 2013 through 2017. Commercial building increased 24% in 2017, with gains for all of the commercial project types except stores. Large office projects that reached groundbreaking in 2017 were the $440 million State Farm Park Center office building complex (phase 2) in Dunwoody, the $240 million Coda office building in Atlanta, the $169 million office portion of the $190 million Kroger store and office building in Atlanta, and the $145 million NCR headquarters office building 2 in Atlanta. The $120 million UPS Majestic Logistics Center at Brown Field also supported the 2017 commercial building increase. Multifamily housing advanced 26% in 2017, and included five projects valued at $100 million or more in Atlanta, led by the $145 million Park Avenue apartment tower and the $142 million Hanover Midtown Apartments.

After climbing 39% in 2016, the Chicago metropolitan area experienced a 26% decline for commercial and multifamily construction starts in 2017. Multifamily housing had soared 80% in 2016, reflecting the start of such Chicago projects as the $780 million multifamily portion of the $900 million Wanda Vista Tower and the $500 million One Bennett Park Tower. For 2017 multifamily housing retreated 24%, with six projects valued at $100 million or more that reached groundbreaking compared to nine such projects in 2016. The largest 2017 multifamily projects in Chicago were the $650 million One Grant Park (phase 1), the $360 million Wolf Point East Tower, and the $280 million One South Halsted Apartment Tower. Commercial building dropped 28% in 2017 following a 10% gain in 2016, with decreased activity for all the commercial project types. Despite the slower pace for commercial building starts in 2017, there were several noteworthy projects that reached groundbreaking, including the $500 million renovation of the Willis Tower in Chicago (with this allocation by project type – office building at $400 million and stores at $100 million), the $211 million CH3 data center in Wood Dale, and a $93 million Amazon fulfillment center in Aurora.

The Seattle metropolitan area saw its commercial and multifamily construction start total for 2017 hold steady with its 2016 amount. While multifamily housing retreated 10%, commercial building improved 8% following its 50% jump in 2016. There were four large office projects in Seattle that were entered as construction starts in 2017 — the $331 million office portion of the $570 million Rainier Square mixed-use building, a $280 million portion of the Amazon Block 21 development, a $228 million office tower, and the $163 million renovation of the Expedia Seattle Campus. In addition, warehouse construction starts strengthened in 2017, helped by a $93 million Amazon distribution center in Sumner and the $80 million Blair Logistics Center in Tacoma. Although down moderately, multifamily housing in 2017 did see groundbreaking for several large projects in Seattle, including the $152 million 1200 Howell St. apartment tower, the $138 million multifamily portion of the Rainier Square mixed-use building, and the $111 million multifamily portion of the $175 million WeWork Seattle mixed-use tower.

The Boston metropolitan area fell 26% in 2017, after seeing its commercial and multifamily construction start total soar 53% in 2016. Commercial building in 2016 had climbed 59%, aided by the start of the $1.7 billion Wynn Casino in Everett, with this allocation by project type — hotel at $465 million and commercial garage at $210 million. (The remaining portion at $975 million was casino and theater space, which is designated by Dodge as amusement-related and falls within the institutional building sector instead of commercial building.) Commercial building in 2017 dropped 22%, including a 56% plunge for hotels. New office starts in 2017 were down 19%, although the year did include groundbreaking for the $200 million 145 Broadway commercial building in Cambridge. Multifamily housing retreated 29% in 2017, relative to the strong amount reached in 2016 with a 49% hike, lifted by such projects that year as the $625 million Seaport Square multifamily complex, the $225 million Clippership Wharf multifamily complex, and the $209 million Bulfinch Crossing multifamily tower. The 2017 multifamily volume was still 5% above its 2015 dollar amount, and included six projects valued at $100 million or more, led by these projects in Boston — the $200 million Residences at 399 Congress St. apartment tower and the $177 million multifamily portion of the $200 million 575 Albany St. mixed-use development.