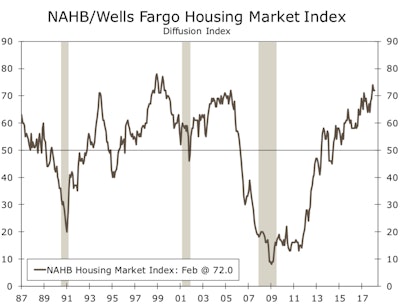

Builder confidence in the market for newly-built single-family homes remained unchanged at a healthy level of 72 in February on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Demand conditions are positive, but supply-side construction hurdles need to be managed, as scarce labor and building material price increases remain top concerns.

In particular, the HMI gauge of future sales expectations has reached a post-recession high, an indicator that consumer demand for housing should grow in the months ahead. With ongoing job creation, increasing owner-occupied household formation, and a tight supply of existing home inventory, the single-family housing sector should continue to strengthen at a gradual but consistent pace.

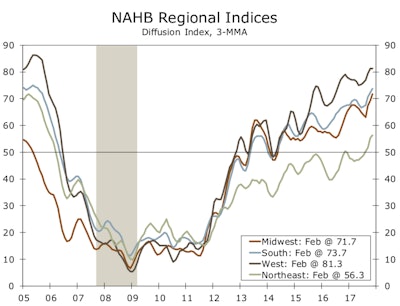

Builder optimism is trending higher in all four regions but is highest in the West and South, which are growing rapidly.Wells Fargo Securities

Builder optimism is trending higher in all four regions but is highest in the West and South, which are growing rapidly.Wells Fargo Securities

The HMI component charting sales expectations in the next six months rose two points to 80, the index measuring buyer traffic held steady at 54, and the component gauging current sales conditions dropped one point to 78.

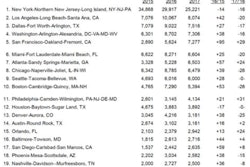

Looking at the three-month moving averages for regional HMI scores, the Midwest rose two points to 72, the South increased one point to 74, the West remained unchanged at 81, and Northeast fell two points to 56.

The HMI tables can be found at nahb.org/hmi.