Consigli is already seeing early signs of potential impacts to the supply chain. "But truthfully, it is too early to tell the broader extent of these impacts," according to the following report from the Consigli, one of the Northeast's largest general contractors.

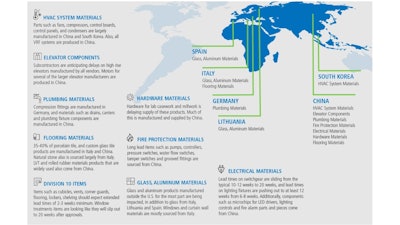

The hardest hit countries that supply materials for our industry are: China, Italy, South Korea, Germany, Spain and France. So far, we’ve found that select components used in electrical fixtures and equipment, mechanical equipment and elevator equipment are of the largest concern due to a mix of manufacturing shutdowns and port of call export restrictions.

Consigli felt it was judicious to offer insight as to how the virus has already impacted, and may continue to impact, the supply chain of materials. Consigli’s Director of Purchasing Peter Capone offers some current thoughts as to what we’re seeing in the marketplace now, and we’ll continue to monitor the situation.

Global

Over the past few weeks (and likely weeks to come), global shipping has been one of the biggest casualties. More tonnage of container ships is idled around the world now than during the global financial crisis, according to Alphaliner, a shipping data service. China’s manufacturing sector has been hampered by efforts to contain the spread of the illness, and earlier this month, the Italian prime minister instituted a nationwide lockdown. Already, some lighting fixture components sourced from China that were ordered prior to the outbreak are back ordered. There are also longer lead times on finishing materials like glass office fronts and stone coming from Italy.

National

About 30% of building materials are imported to the U.S. come from China, making the country the biggest single supplier, according to Dodge Data. U.S. contractors are already seeing the impacts of the coronavirus on supply chains for building material—from shipping delays to a need to re-source products domestically. And the country is faced with uncertainties over how long countries will be on lockdown, how crews will be impacted and whether project deadlines will have to be pushed out. The American Association of Port Authorities also announced earlier this month that first-quarter cargo volumes at U.S. ports could drop 20% or more from 2019 levels because of supply chain disruptions caused by the coronavirus.

Regional

Supply of materials in the Northeast mirrors what we’re seeing nationally with the exception of imports from Canada; however, materials sourced from Canada (such as structural steel and HVAC equipment) are also starting to become concerning. Newly implemented travel restrictions have not blocked the import of materials, but Canada is ramping up its precautionary measures daily which will eventually affect manufacturing output.

Potential delays

Manufacturing Shutdowns -- While factories in China are continuing to come back online as the spread of the virus subsides and materials will begin to flow again, there are still issues affecting cargo movement and back up delays.

Port of Call Export Restrictions -- COVID-19 is expected to create “a longer and larger impact” on imports flowing into major U.S. container ports than previously believed due to factory shutdowns and travel restrictions in China that continue to affect production, according to the National Retail Federation (NRF). There is still a lot of uncertainty as to the long-term impact on the supply chain.

Precautionary measures

Within the last several weeks, all of our project teams have, and will continue to, take the following precautions:

- Identify project specific “long lead time/high-risk” materials sourced abroad;

- Communicate daily with subcontractors to track these materials as they move through the process;

- Discuss contingency plans for sourcing “alternate” manufacturers, when prudent;

- Work with design teams, during design development, to avoid sourcing materials from high-risk manufacturers;

- Collect and share information daily through a centralized tracking portal;

- Expedite remaining buyout to avoid domestic material demand issues.

Looking ahead

To continue moving projects along both on time and safely, Consigli recommends teams evaluate their contracts and communicate with all project teams, subcontractors and vendors. Consigli is also now looking at sourcing materials earlier than it normally would and possibly looking to rely more heavily on domestic suppliers.

More positively, we are seeing that Chinese manufacturers are back online and slowly returning to full capacity. We anticipate a portion of these potential supply delays will resolve in the coming weeks, and we will maintain open communication in the coming weeks as supply logistics play out and circumstances evolve.

Stay safe and healthy, and rest assured we are all in this together.