The 43rd Annual Wells Fargo Construction Industry Forecast was recently released. The survey, conducted in late 2018, gathers opinions Base: Contractors whose company would consider buying construction equipment -- 244 in 2019, 150 in 2018, 194 in 2017, 248 in 2016

Base: Contractors whose company would consider buying construction equipment -- 244 in 2019, 150 in 2018, 194 in 2017, 248 in 2016

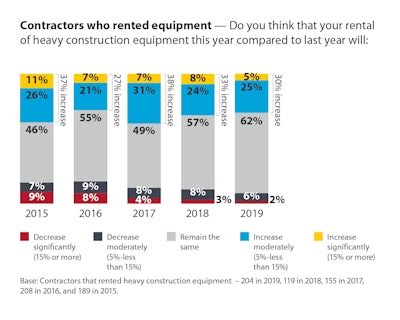

“Last year, a lot of construction industry companies had record sales and profits last year," says Peter Gregory, national manager for Wells Fargo Equipment Finance Construction Manufacturer and Dealer Services Group. "As I’ve talked to our rental clients over the past few months, they all are expecting another great year. There appears to be a really good pipeline of future construction work which aligns with the high optimism we are seeing

He continues, “Last year, due to long equipment order backlogs from many manufacturers, we saw that a lot of dealers were having to sell equipment out of their rental fleet in order to not lose sales opportunities to their clients. They will continue to replace that rental equipment this year as new equipment arrives. Most are very optimistic that the demand for sales and rentals will continue to be strong in 2019.”

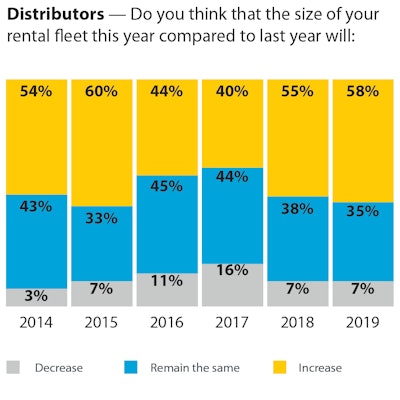

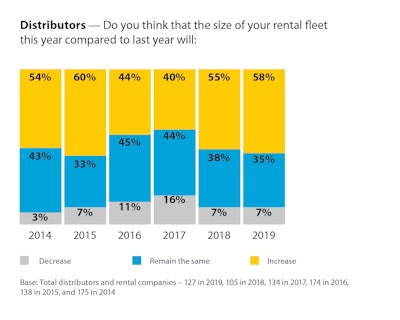

- Distributors who responded indicate that they will continue to grow their rentals fleets as demand from contractors continues to grow. Fifty-eight percent of distributors expect to grow their rental fleet and 35 percent expect their fleet to remain the same size. This is great news for manufacturers as even when a distributor is maintain their current fleet size, they are replacing older units or

Base: Total distributors and rental companies -- 127 in 2019, 105 in 2018, 134 in 2017, 174 in 2016, and 175 in 2014

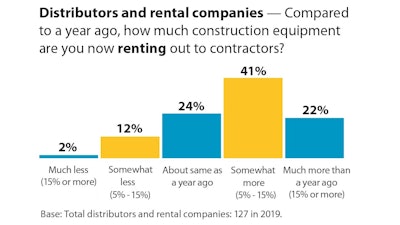

Base: Total distributors and rental companies -- 127 in 2019, 105 in 2018, 134 in 2017, 174 in 2016, and 175 in 2014 - Respondents who rent equipment reported flexibility continues to be the No. 1 reason why contractors rent equipment, but building equity before purchasing the equipment increased dramatically from 9 percent to 2 percent and is now the No. 2 reason.

- Having a strong backlog of jobs, and having long-term confidence in the local economy, are the top two things that contractors surveyed need to see before they want to buy construction equipment.