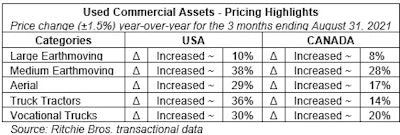

Ritchie Bros.' September Market Trends Report continues to show positive pricing trends across all its equipment indexes, with aerial equipment prices up 29% in the United States, while medium earthmoving and truck tractors are up 38% and 36% respectively (for the three months ending August 31, 2021).

With this month's report, Ritchie Bros. has included a special focus on aerial work platforms and material handling equipment sales in the United States and Canada. High-usage and rental rates, as well as OEM production delays, have resulted in a sharp decline in the number of boom lifts, scissor lifts, and telescopic forklifts sold in 2021. Over the past three months scissor lift prices have inflated 15%, while boom lifts and telescopic forklifts are both up 16%.

"Buyers are paying a premium right now for aerial work platforms due to supply constraints, record-high rental rates, strong demand, and the amount of work available," said Doug Olive, Senior Vice President (Pricing), Ritchie Bros.

Doug Rusch, Managing Director of Rouse Sales, added, "Retail pricing for boom and scissor lifts has risen slowly but steadily this year, with values 6% higher now than January 2021. Meanwhile, telescopic forklifts prices are running 9% higher than the beginning of the year while volumes have soared, with Rouse seeing approximately 75% more telescopic forklifts sold through retail channels this year than the same time period in 2019, pre-pandemic."