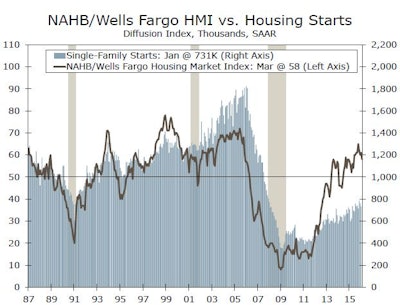

Despite consensus expectations for a slight gain, home builder confidence in the market for newly-built single-family homes held steady at a reading of 58 in March. While builder sentiment measured by the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) has moderated recently, the index remains well above 50, signaling steady gains in the single-family housing market in 2016.

The South and the Northeast regional indices picked up modestly in March, increasing to a level of 59 and 46, respectively. Builder confidence in the Midwest and the West remained unchanged.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as "good," "fair" or "poor." The survey also asks builders to rate traffic of prospective buyers as "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The only decline was seen in the future sales index, which dropped 3 points to a level of 61. Notably, this component has fallen 14 points from its cycle-high of 75 reached in Oct. 2015. The 4 point gain in prospective buyer traffic offset the decline in future sales, while the present sales index was unchanged.