There are now 1,170,000 mobile elevating work platforms (MEWPs), also known as aerial work platforms (AWPs), in the worldwide rental fleet. This is up 4% from the previous year, reveals new research commissioned by the International Powered Access Federation (IPAF).

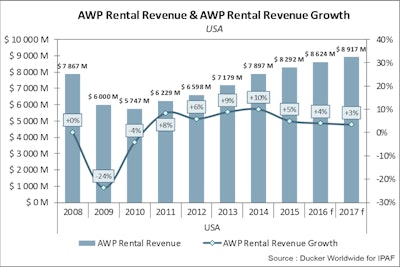

The US AWP rental market recorded moderate growth of 5% in 2015 to reach approximately $8.3 billion, according to the IPAF US Powered Access Rental Market Report 2016. The US AWP rental fleet expanded by 3% in 2015 to exceed 530,000 units. Due to the current slowdown in the oil sector, the proportion of construction end-markets in AWP rental increased slightly to reach 73% in 2015.

The Chinese MEWP rental fleet grew by about 35% in 2015 to reach approximately 12,200 units.

The European MEWP rental market grew by 3% in 2015 and is estimated at approximately €2.7 billion, according to the IPAF European Powered Access Rental Market Report 2016. Fleet expansion continued at a moderate pace to reach 313,000 units. The 10 European countries surveyed were: Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden and the UK.

Four groups can be identified among the European countries:

- Spain and Italy are chalking up the highest growth and are well beyond the recession with growth at or above 5% in 2015.

- Sweden and Germany remain highly dynamic markets with continuous positive growth at +5%.

- In comparison, the UK and Norway, traditionally dynamic markets, are showing signs of slower growth.

- Finland, France, the Netherlands and Denmark are showing stabilisation to slight growth, but are all exiting from recession.

The IPAF rental market reports are presented in an easy-to-read format, highlighting key facts and figures for senior management, such as fleet size, utilization rate and retention period. They include an estimate of the size of the MEWP/AWP rental fleet worldwide, with a breakdown by region and machine type.

New aspects covered in the 2016 reports include: details on construction and non-construction sub-sectors in MEWP rental revenue, utilization rates by equipment type (booms vs. scissors), and preliminary estimates of the number of operators trained annually.

The US report includes Canada. The European report includes seven individual country/regional sections: France, Germany, Italy, the Netherlands, Nordic/Scandinavian countries (covering Denmark, Finland, Norway and Sweden), Spain and UK.

The IPAF US and European Powered Access Rental Market Reports 2016 are available in English and can be purchased at www.ipaf.org/reports