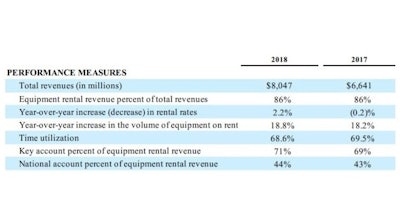

United Rentals, Inc. announced financial results for the fourth quarter and full year 2018, reporting that for the quarter, year-over-year, adjusted EBITDA increased 18.0% to a company record $1.117 billion and adjusted EBITDA margin decreased 90 basis point to 48.4%. The decline in adjusted EBITDA margin primarily reflected the impact of the acquisitions completed in 2018.

For the year, Return on Invested Capital (ROIC) increased to a company record of 11.0%, while net cash provided by operating activities was $2.853 billion and free cash flow, excluding merger and restructuring related payments, set a company record at $1.334 billion.

For the fourth quarter of 2018, total revenue increased 20% to $2.306 billion and rental revenue increased 20.8% to $1.989 billion. On a GAAP basis, the company reported fourth quarter net income of $310 million, or $3.80 per diluted share ("EPS"), compared with $897 million, or $10.45 per diluted share, for the same period in 2017. Adjusted EPS2 for the quarter was $4.85 per diluted share, compared with $11.37 for the same period in 2017. The fourth quarter of 2017 included a net income benefit estimated at $689 million, or $8.03 per diluted share, associated with the enacted tax reform discussed below. Excluding this benefit, EPS and adjusted EPS for the fourth quarter of 2017 would have been $2.42 and $3.34, respectively. The reduction in the tax rate discussed below contributed an estimated $0.68 and $0.86 to EPS and adjusted EPS, respectively, for the fourth quarter of 2018.

Michael Kneeland, chief executive officer of United Rentals, said, "We delivered strong fourth quarter results, including broad volume growth and rental rate improvement, in a year that leveraged our numerous competitive advantages. Our integration of major acquisitions expanded our service offering, and we gained traction from investments in fleet and technology. For the full year, we grew pro forma rental revenue by 10.5%, improved our adjusted EBITDA margin, and increased ROIC to a record 11%."

Kneeland continued, "Our momentum in the quarter gave us a strong start to 2019, when we expect to once again outpace the industry. By reaffirming our guidance, we’re underscoring our confidence in the cycle and our differentiation in the marketplace. Customer feedback, as well as key internal and external indicators, continue to point to healthy end-market activity. We remain focused on balancing growth, margins, returns and free cash flow to maximize shareholder value."

Fourth Quarter Highlights

- Rental revenue4 increased 20.8% year-over-year. Owned equipment rental revenue increased 18.8%, reflecting increases of 16.8% in the volume of equipment on rent and 2.2% in rental rates.

- Pro forma1 rental revenue increased 8.5% year-over-year, reflecting growth of 4.3% in the volume of equipment on rent and a 2.4% increase in rental rates.

- Time utilization decreased 120 basis points year-over-year to 68.8%, primarily reflecting the impact of the BakerCorp and BlueLine acquisitions. On a pro forma basis, time utilization decreased 60 basis points year-over-year to 69.0%.