Have you ever wondered how your truck fleet size compares to other businesses? Or what types of compressed air systems businesses similar to yours may be using?

VMAC, a leading onboard compressor manufacturer, set out to help vehicle owners, operators, mechanics and fleet managers answer these and other questions with its “State of the Mobile Compressed Air Industry" survey report. It is intended to enable businesses to compare themselves against their peers in the mobile compressed air industry in five key categories: fleets, truck classes, commercial vans, general equipment and mobile compressed air.

“We’re pleased to release this report to members of the industry, providing them with a benchmark for comparing themselves and their business to their industry peers,” says Mike Pettigrew, VMAC’s Marketing Manager. “By highlighting and analyzing industry trends, VMAC’s report will help business owners and managers plan for the future.”

“VMAC’s 2020 'State Of The Mobile Compressed Air Industry' report identifies trends associated with service vehicle life cycles, truck class sizes, commercial van popularity, CFM and psi requirements on service vehicles, and more” explains Anne Fortin, Digital Marketing Specialist. “By making our data readily available, we hope to provide another resource for members of the industry to use when conducting industry analysis, and empower them to make even more educated decisions that will benefit their business.”

VMAC surveyed 205 individuals from October 2019 to January 2020 to develop the survey, which compiles data from a range of industry professionals in varying industries, including construction, equipment repair, mining, oil and gas, and agriculture. Most survey respondents were owners, operators or mechanics, with the remainder made up of fleet managers, sales and marketing staff, and upfitters.

Key findings included:

- Most survey respondents (58%) were part of small fleets ranging from one to five service trucks. Large fleets of more than 100 trucks accounted for just 7% of respondents. Newer vehicles aged 0 to 9 years made up 74% of respondents’ fleets.

- Seventy percent of respondents indicated they have Class 2/3 trucks, while almost half (46%) indicated they had Class 4/5 trucks. Only 26% of respondents had Class 6/7 vehicles and just 13% has Class 8 trucks.

- More than half (55%) indicated there was at least one service van with an air compressor in their fleet.

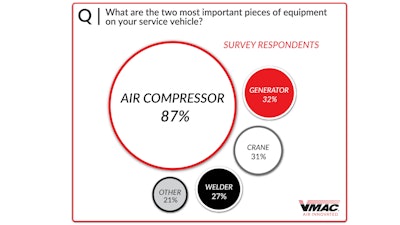

- A significant portion of respondents (87%) chose an air compressor as one of their top two most important pieces of equipment on their service vehicles. Generators, cranes and welders were each selected by roughly a third of respondents at 32%, 31% and 27%, respectively.

- More than half (54%) of respondents stated they only required up to 59 cfm of compressed air on their service vehicles. Forty percent indicated they required from 60 up to 149 cfm, and only 6% required 150 cfm or above.

- A notable 67% indicated they prefer rotary screw air compressors over reciprocating compressors for their service vehicles. Performance (83%) was cited as the top reason for this preference, followed by size and weight (39%) and quality/reliability (38%).

- Above-deck gas engine drive (22%) was noted as the most popular method for powering vehicle air compressors, closely followed by above-deck diesel engine drive (19%) and UNDERHOOD/engine drive (19%). Though deck-mounted air compressors also ranked as the top preferred type among over half of respondents, UNDERHOOD/engine drive compressors came in second (27%) in respondent preference.

Because the survey took place prior to the pandemic, the "State Of The Mobile Compressed Air Industry" report does not reflect any changes the COVID-19 pandemic may have caused within the industry. However, this allows VMAC to compare the pre-COVID-19 data against the data that will be collected when the survey is conducted again in 2021.

To learn more, click here to download the free report.