“Nonresidential construction backlog declined for a second consecutive month as skills and input shortages hammer the industry,” said Associated Builders and Contractors Chief Economist Anirban Basu. “A growing number of contractors are indicating shortages of materials such as copper and PVC pipes.”

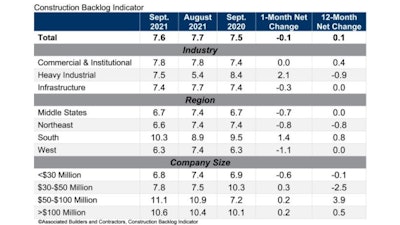

The Construction Backlog Indicator fell to 7.6 months in September, according to an ABC member survey conducted Sept. 20 through Oct. 4. The reading is down 0.1 months from August 2021, but up 0.1 months from September 2020.

“Input prices also continue to increase as global supply chain disruptions persist,” said Basu. “Rising shipping and trucking costs are further exacerbating the situation by placing additional upward pressure on input prices. Working in conjunction with skills shortages and attendant higher wages, rising input prices are resulting in lofty bids, inducing certain project owners to delay work and even cancel projects altogether in some instances.

“The good news is that demand for construction services remains elevated,” said Basu. “Many projects, whether those in health care, public education or data management, must move forward, and the data indicate that this is disproportionately benefiting larger contractors. For the most part, recent declines in backlog have been registered among smaller construction firms. Low interest rates and abundant liquidity have created the capacity for many investors to deploy substantial capital, and that helps support investment in real estate and construction projects.

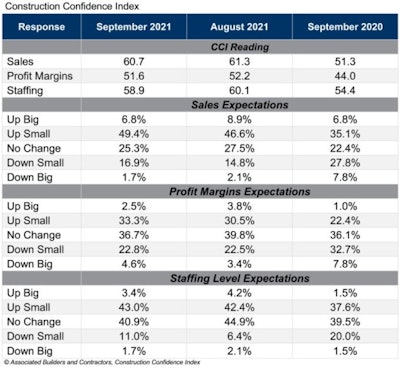

“Despite all the challenges facing the nonresidential construction industry, contractors collectively expect sales, staffing and profit margins to expand over the next six months, though the level of confidence has been diminished in recent months,” said Basu.

ABC’s Construction Confidence Index readings – a measure of contractor confidence in growth of sales, profit margins and staffing levels – each declined in September. But each remains above the threshold of 50, indicating expectations of growth over the next six months. Click on this table for a larger viewAssociated Builders and Contractors Construction Confidence Index

Click on this table for a larger viewAssociated Builders and Contractors Construction Confidence Index

Coincidentally, the Wells Fargo Economics Group trimmed its forecast for the overall U.S. economy in light of the choke hold that even a fading pandemic has maintained over supply of all kinds of inputs, materials and goods. Wells Fargo dropped its 2022 growth forecast half a percentage point to 4.0%, and expects economic activity to really accelerate, “as supply chains normalize, perhaps as soon as the second half of next year.”

The seven-day moving average of new COVID cases has fallen to about 85,000, after exceeding 170,000 at its September 13 peak. But as one problem fades, another has worsened. In recent weeks, supply chain issues have shifted from a major headache to an outright crisis.

Wells Fargo’s economists remain concerned about COVID’s impact on consumer spending, but significant retrenchment in consumer spending does not appear likely unless the new COVID case count shoots markedly higher from its current level.

“We forecast that real GDP in the United States will grow 5.6% in 2021,” says Jay H. Bryson, Ph.D and chief economist with Wells Farog. “That still marks the strongest full year for U.S. economic growth since 1984, but it is a meaningful downgrade from the 7.3% rate that we forecasted in early June when new COVID cases were averaging roughly 15,000 per day and before prospects for a more vibrant rebound were ruined by the Delta variant.”

Materials are not the only thing in short supply. Job growth has been only tepid in recent months as a record share of businesses report that workers are hard to find. Consumers agree. Of those surveyed by the University of Michigan, more people are saying that jobs are plentiful than at any point in the past half century. The problem is not on the demand side, it is a labor supply problem, as many still fear COVID in the workplace, cannot find or afford childcare or are simply unable or unwilling to do the jobs available today.

“Still, above-trend real GDP growth should lead to solid growth in payrolls in coming months, and we look for the unemployment rate, which currently stands at 4.8%, to trend lower over our forecast period,” says Bryson. “With the economy growing at an above-trend rate and the labor market continuing to heal, we believe that the Federal Open Market Committee (FOMC) will eventually take its foot off of the monetary-policy accelerator.”

Headline inflation numbers on personal consumption expenditures reflect the highest seen in more than 30 years.

The Federal Reserve currently purchases $80 billion of Treasury securities and $40 billion of mortgage-backed securities per month. Specific timing of the Fed’s tapering their expenditures was thrown into doubt by lackluster job growth in September, “Although we suspect the taper announcement is more likely at the November 3 meeting than the one that takes place on December 15,” says Bryson. “We think policymakers will set the pace such that purchases cease by mid-2022, which should contribute to the upward creep in long-term interest rates that we will forecast in coming quarters.

“Rate hikes are not on the docket, however, as the FOMC will likely wait until the labor market is nearing ‘maximum’ employment until it begins to hike rates, a condition that we do not believe will be met until the second half of 2023. We forecast that the committee will raise its target range for the fed funds rate 75 bps in the last two quarters of 2023.”

Wells Fargo expects residential investment overall to maintain its momentum, as slight moderating in single-family buying is offset by accelerating multifamily spending.

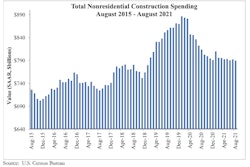

Total nonresidential expenditures year-to-date are down 6.7% compared to in the first eight months of 2020, and most major categories of nonresidential spending remain weak. While Wells Fargo modestly reduced its outlook for structures spending, the bank’s economists still foresee a solid pace of improvement in the years ahead.

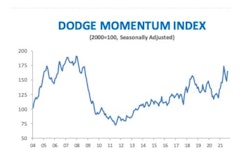

“The Architectural Billings Index, which leads nonresidential construction spending by about a year, has been in expansion territory (over 50) for seven straight months, which suggests nonresidential activity should strengthen. However, building material pricing and availability remain significant impediments. Scarcities of skilled labor have also become a headwind for the construction industry.”