Due largely to the burst of business activity in the spring and early summer, thanks in part to rising vaccination rates, annual U.S. GDP growth is projected at 5.3% for 2021, a factor that will help to maintain investment momentum throughout 2021. Annual equipment and software investment is currently forecast to expand 13.2% for 2021, according to the Q4 update to the 2021 Equipment Leasing & Finance U.S. Economic Outlook released by the Equipment Leasing & Finance Foundation. A separate report released with the Outlook projects investment in construction machinery and other industrial equipment will remain elevated over the next three to six months.

The U.S. Economic Outlook, which is focused on the nearly $1 trillion equipment leasing and finance industry, highlights key trends in equipment investment and places them in the context of the broader U.S. economic climate. The Foundation produces the Outlook report in partnership with economic and public policy consulting firm Keybridge Research.

Robust Economy Propels Positive Outlook

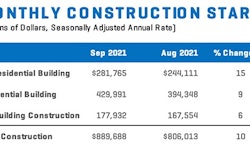

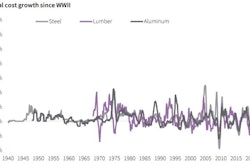

According to the Q4 update, the U.S. economy expanded at a robust 6.7% (revised) annualized rate in Q2 2021, about the same pace as in the first quarter. U.S. GDP is now above the level achieved at the end of 2019, before the pandemic began. The U.S. manufacturing sector has reaped the benefits and is expected to face historically high levels of demand, despite the growth deceleration seen in the prior quarter. U.S. industrial output has been constrained, however, by ongoing supply chain issues and high input prices, making it difficult to keep up with demand.

Prospects for U.S. businesses have also been tempered somewhat by the resurgence of COVID-19, which has reduced consumer mobility, spending and confidence. Many businesses, particularly small ones, are contending with labor shortages, supply chain delays and inflationary pressures, which the Federal Reserve deems “temporary.”

Fortunately, businesses appear better equipped to handle the headwinds due to healthy lending activity and a slow, steady rise in vaccination rates. As a result, business investment has remained strong, with equipment and software investments rising 12.7% (annualized) in Q2 and tracking well above pre-pandemic levels.

According to the latest Outlook, factors to watch for through the remainder of 2021 include:

- concerns of persistently high inflation,

- uncertainty surrounding fiscal policy,

- the potential for tighter financial conditions that could impact equity markets,

- and the trajectory of the pandemic.

“The Q4 update indicates that optimism eased somewhat as the spread of the COVID-19 Delta variant began weighing on consumer confidence and economic activity. The trajectory of the virus this fall and winter, inflation, and fiscal policy are the most significant unknowns to consider during the upcoming six months,” said Scott Thacker, Foundation Chair and CEO of Ivory Consulting Corporation. “Fortunately, the overall outlook portrayed in the Q4 update is more optimistic than it was a year ago. Businesses continue to invest despite supply chain issues and labor shortages, which bodes well for the equipment finance industry.”

Download the full report at https://www.leasefoundation.org/industry-resources/u-s-economic-outlook/.

Accelerated Investment in Most Sectors

The Foundation-Keybridge U.S. Equipment & Software Investment Momentum Monitor, which tracks 12 equipment and software investment verticals, was released in conjunction with the Economic Outlook. In addition, the Momentum Monitor Sector Matrix provides a customized data visualization of current values of each of the 12 verticals based on recent momentum and historical strength.

During the period studied, eight verticals showed signs of accelerating investment, and four other verticals are showing signs of peaking. Projections for the next three to six months, year over year, indicate:

- Construction machinery investment growth will stay elevated.

- Materials handling equipment investment growth should remain robust.

- All other industrial equipment investment growth should remain elevated.

- Mining and oilfield machinery investment growth should accelerate.

- Trucks investment growth should remain robust.

- Agriculture machinery investment growth may ease, though year-over-year growth will likely remain in positive territory.

- Medical equipment investment growth will likely remain in positive territory.

- Aircraft investment growth will remain elevated, though may have peaked.

- Ships and boats investment growth should remain healthy.

- Railroad equipment investment growth should continue to improve, though upside potential may be limited.

- Computers investment growth should remain in positive territory and may even accelerate.

- Software investment growth should remain elevated.

The full report of the Momentum Monitor is now available at https://www.leasefoundation.org/industry-resources/momentum-monitor/.

Information provided by the Equipment Leasing & Finance Foundation and edited by Becky Schultz.